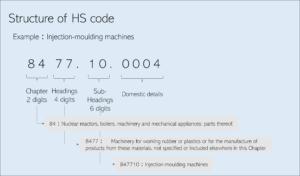

HS codes are classified by cross-checking between the HS code table, headings and chapter's notes, and other relevant information including commentaries, prior guidance cases, based on the HS General Rules.

It is important to note that there have been many cases in which it is easy to think that a product applies to a certain section (the first four digits of the HS code) by simply looking at the name in the HS table, but according to the notes and explanations, it should be specified in another section. The tariff rate varies depending on the HS code. In addition, in the case of the FTA (Free Trade Agreement) application, the rules of origin also change depending on the HS code, so it is necessary to determine the actual HS code with the utmost care.

We provide HS codes determination service. Please feel free to contact us if you're concerned about anything related to HS classification.

Reference information used for HS classification

Here are some links to reference information for HS classification.

- GENERAL RULES FOR THE INTERPRETATION OF THE HARMONIZED SYSTEM

- Tariff Schedule (HS Table - Japan Customs)

- Customs Rulings Search System (US)

- Advance Ruling on Classification (Japan Customs)

- HS Explanatory note (Japanese)

FTA/EPA, Customs and International Trade Advisory Services

ACP Service, Attorney for Customs Procedure

Customs Support for Transfer Pricing Adjustments

Our Customers - Japan IOR / Attorney for Customs Procedures (ACP) Service

All our clients have successfully become Japan Importer of Record (IOR) and imported goods into Japan under our guidance.

Logistics Companies with Collaboration Experience

Here is a list of our partner logistics and forwarding companies with whom we have had successful collaborations. Please note that this list is not exhaustive, as we are open to working with any logistics or forwarding companies. As Attorneys for Customs Procedures (ACP), we represent non-resident clients (IOR) and coordinate with these logistics companies, who manage the transportation of goods to and from Japan.