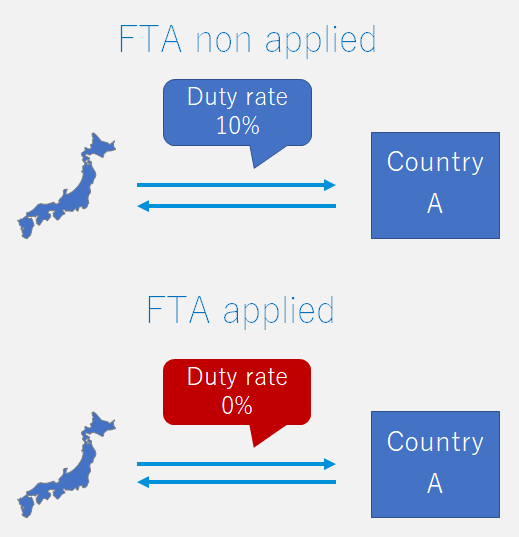

The benefit of FTA is straightforward, that is, the customs duty savings opportunities with lower or zero duty rates.

For instance, if you do trading business between Japan and Country A, if you do not apply FTA, you shall be dutiable with the standard duty rate, e.g. 10%.

However, you can enjoy lower or duty-free, once your imported goods are eligible for FTA.

It should note, to become eligible to take advantage of FTA, the importer has to prepare the appropriate documents such as a Certificate of Origin or Declaration of Origin.

To issue such documents, you need to go through the origin determination process, which should be in accordance with each FTA’s compliance rule "Rule of Origin".

This determination process is relatively complicated, so we support clients for guiding that process so that importers can properly enjoy the FTA duty rate.

FTA, Customs and International Trade Advisory Services

YouTube - What is FTA (Free Trade Agreement)? How to use FTA in Japan to minimize tariff costs