Variety of Customer Needs for ACP Services:

Customers’ business models and their need for an Attorney for Customs Procedures (ACP) vary depending on the specific business structure. Let's explore some actual cases where non-resident entities require ACP to import goods.

E-Commerce Business:

One common scenario involves non-resident entities importing goods themselves through platforms like Amazon's FBA services, Rakuten, or Shopify. In such cases, it is essential for the non-resident entity to appoint an ACP for their imports to Japan. At SK Advisory, we register over 100 international Amazon sellers as ACP clients each year.

VMI - Vendor Managed Inventory:

VMI, also known as Vendor Managed Inventory, is another situation where the vendor or supplier manages inventory after importing goods into Japan. This practice is often observed in industries such as automotive and machinery.

Consignment Business:

In the consignment business model, foreign companies engage a Sales Agent in Japan while retaining ownership of their goods, even after their importation into Japan. In this scenario, the foreign company should act as the Importer of Record (IOR) by utilizing an Attorney for Customs Procedures (ACP).

Data Center / Colocation Business:

With the growing demand for deliveries to data centers, non-resident entities seek to import computer equipment, including server-related products, to facilitate colocation services in Japanese data centers. SK Advisory has supported numerous projects involving the delivery of such products to data centers, including prominent facilities like Equinix and AT TOKYO Data Center.

Other Businesses Requiring Imports by Non-Resident Entities:

There are also cases where the buyer in Japan requests the non-resident seller to import and deliver goods to a specific destination in Japan under a DDP (Delivered Duty Paid) arrangement.

Contact

Contact us 24 hours through the form

Recommended Content

Please Be Aware

- In cases where foreign corporations (non-residents) without an office in Japan import or export goods, failure to properly prepare an Importer of Record (IOR) or Exporter of Record (EOR) through an Attorney for Customs Procedures (ACP) or similar means can result in goods being held at customs, leading to significant delays and costs. To avoid such risks, please make thorough preparations.

- If an ACP is needed, it is crucial to utilize the services of an experienced ACP well-versed in customs-related laws and regulations. The import and export operations of non-residents/foreign corporations using an ACP are treated as unique cases. Many customs brokers are not familiar with these procedures, leading to incidents where goods are detained for extended periods due to unsuccessful explanations to customs. (Customs will not permit the import if the explanations provided by the importer or customs broker are unsatisfactory, resulting in the goods being detained until customs is convinced.)

- We highly recommend utilizing our services as professional experts in customs, knowledgeable about customs-related laws and regulations. With a proven track record of resolving numerous issues through direct consultations with customs officers and customs brokers, our clients supported as an ACP now exceed 200 companies. We are committed to delivering industry-leading results with our expertise.

Japanese Customs System Reform: Clarification of Importer Definitions

Starting October 1, 2023, Japanese Customs has instituted a pivotal reform aimed at addressing the issue of foreign sellers improperly designating third parties (such as forwarders or customs agents) as importers.

This revision necessitates foreign corporations to utilize an Attorney for Customs Procedures (ACP) to assume the role of Importer of Record (IOR) directly in many cases. The practice of merely nominally appointing another entity as the importer is no longer feasible.

Notably, foreign corporations that act as importers themselves, through the engagement of ACP, are eligible for Japan Consumption Tax (JCT) benefits. (link: Consumption Tax Treatment and Benefits of Using ACP).

As a dedicated ACP firm, we ensure compliance with the law to facilitate correct import procedures, allowing you to trust us with your importation requirements confidently. We are eager to engage in further discussions with you.

Revisions Effective October 1, 2023:

Definition of the Importer

- Regarding a cargo imported under import transaction, an importer is equivalent to “a person who imports a cargo” defined in Article 6-1 (1), General Notification of the Customs Act. ….. This means, the Consignee, etc., in the case of imports conducted through normal transactions between an overseas seller and a Japanese buyer

- In the cases other than above, an importer is a Person Having the Right of Disposal of the import cargo at the time of import declaration. If there is another person who acts on the purpose of the import*, that person is also included:

In case of a cargo imported:

- under lease contracts, a person who rents and uses the cargo.

- for consignment sales, a person who sells the cargo in the name of himself/herself (consignee) by accepting the commission.

- for processing or repairing, a person who processes or repairs the cargo.

- for disposal, a person who disposes the cargo.

Importer Defined as the “Person Having the Right of Disposal”

One of the most notable aspects of the amendment is the clarification that the “person having the right of disposal” is regarded as the importer under Japan Customs law. The term “right of disposal” is similar to ownership, but not identical. Although there is no explicit definition in the customs-related legislation, according to Japan Customs, it refers to the authority to decide how the goods will be handled after being released into Japan—for example, whether to sell the goods or to enter into a sales contract.

For additional information, please refer to the following resources:

- Japan Customs: Leaflet(English) Revision of Import Declaration Items and Attorney for Customs Procedure (ACP) System

- English: Announcement from Japan Customs | Mandatory to Use ACP in Many Cases – Attorney for Customs Procedure

Contact

Contact us 24 hours through the form

Why choose us?

We specialize in navigating complex issues at the intersection of customs procedures and taxation—an area where our ability to offer practical, comprehensive support from both perspectives sets us apart. Understanding the close relationship between customs duties and national taxes (especially, Japan Consumption Tax - JCT), and addressing both in an integrated manner, is crucial in the context of international trade.

- Customs and International Trade Professionals - Led by our CEO, Mr. Sawada—Certified Customs Specialist and former KPMG professional—SK Advisory provides expert-level support in Customs and international trade. Mr. Sawada also serves as an external expert for the World Bank’s B-READY project in the field of customs and international trade.

- Full Compliance with Japanese Customs Law - We ensure full adherence to Japanese Customs Law, including Importer of Record (IOR) structure, HS code classification, and customs valuation. We assist in preparing all essential shipping documents for non-resident entities.

- One-Stop ACP and JCT Tax Representative Service - We offer a fully integrated service for both ACP and JCT Tax Representative needs. Our expertise enables efficient deduction or refund of import JCT through accurate JCT tax filings.

- Multilingual Communication - Our team communicates fluently in English, Japanese, and Chinese, offering smooth coordination with global clients and authorities in Japan.

- Support for Regulated Products - Our ACP/IOR partnership system can manage regulated items, including cosmetics, PSE-products, foodstuffs, and tableware.

- Trusted by Global Clients - Serving around 100 ACP clients annually, including many Amazon sellers, we’re a certified provider on Amazon SPN (Service Provider Network) under Trade Compliance.

Contact

Contact us 24 hours through the form

Track Record – Attorney for Customs Procedures (ACP) Services

We have supported import and export operations in Japan for over 200 clients across more than 40 countries.

Examples of International Logistics Partners We Have Worked With

We have a proven track record of working with a wide range of logistics providers. As the Attorney for Customs Procedures (ACP), we handle customs-related responsibilities while logistics companies manage transportation and warehousing operations.

- American Overseas Transport (AOT)

- Apex International

- Brink's

- CEVA Logistics

- Coshipper

- Crane Worldwide Logistics

- DB Schenker

- DGX (Dependable Global Express)

- DHL Express

- DHL Global Forwarding

- Dimerco

- DSV Air & Sea

- Expeditors

- FedEx Express

- FERCAM

- GOTO KAISOTEN Ltd.

- Harumigumi

- Herport

- ICL Logistics

- JAS Forwarding

- Kintetsu Express

- Kokusai Express

- Kuehne + Nagel

- Mitsubishi Logistics

- MOL Logistics

- Nankai Express

- Nippon Express

- OIA Global

- PGS

- Rhenus Group

- Röhlig

- Sankyu

- Sanyo Logistics

- Scan Global Logistics

- Seino Schenker

- SEKO Logistics

- Shibusawa Logistics Corporation

- Shin-Ei gumi

- Shiproad

- Sumitomo Warehouse

- UPS

- UPS Supply Chain Solutions

- Yamato Transport

...and many other logistics providers in Japan and around the world.

Recommended Content

Contact

Contact us 24 hours through the form

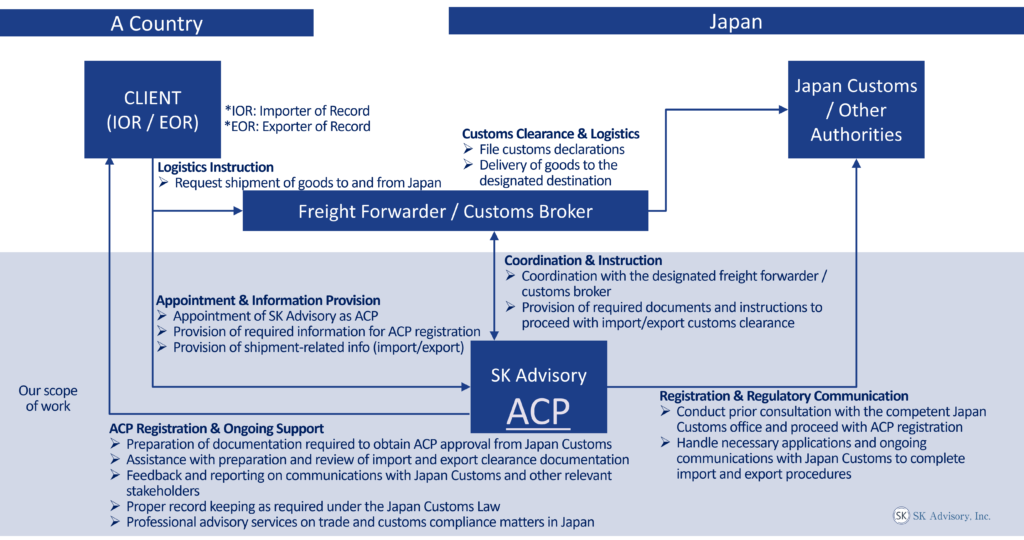

Our ACP Service: The Best Solution for the Japan Importer of Record (IOR) and Exporter of Record (EOR)

ACP is an effective solution for addressing Importer of Record (IOR) and Exporter of Record (EOR) requirements in Japan. Through our ACP service, non-resident entities located outside Japan are able to import and export goods as Non-Resident IOR and EOR.

Below is an overview of our basic scope of work, together with a diagram illustrating the operational structure of the ACP service. Once ACP registration is completed, the non-resident entity can act as the Importer of Record (IOR) and Exporter of Record (EOR) in Japan.

Scope of Work – How We Can Assist

- Consultation with Japan Customs to support successful ACP registration.

- Liaison with relevant stakeholders, including freight forwarders and Japan Customs, to ensure the smooth and compliant import and export of goods.

- Assistance in preparing and reviewing import and export clearance documentation.

- Support in the calculation of customs value, in accordance with the Japan Customs Tariff Act.

- Assistance with advance rulings on HS classification, customs valuation, and rules of origin.

- Import compliance support for regulated products, including Domestic Administrator (sometimes referred to as “Domestic Representative”) Services under the Product Safety Acts (PSE/PSC) and food-related products regulated under the Food Sanitation Act.

- Support for security export control, including list-based classification, catch-all control assessment, and assistance with export license applications to the Ministry of Economy, Trade and Industry (METI).

- Record-keeping support in accordance with Article 95 of the Japan Customs Law.

- Provision of professional trade and customs advisory services to address and resolve issues that may arise during import or export operations.

**Both import and export activities can benefit from the use of an ACP (Attorney for Customs Procedures). This support is applicable in scenarios where a non-resident acts as the Importer of Record (IOR) for imports and as the Exporter of Record (EOR) for exports.

Three Steps to Initiate Shipments Under the ACP Program:

Quotation Review to Contract Conclusion: Upon receiving your contact details, we will promptly provide a quotation for your review.

Commencing the Registration of ACP (Attorney for Customs Procedures) to Japan Customs: This process is generally completed in about two weeks.

Initiation of First Shipment, Import/Export

Recommended Content

Contact

Contact us 24 hours through the form

FAQ for ACP (Attorney for Customs Procedures)

What is the role of ACP (SK Advisory)?

- Representation: ACP (SK Advisory) represents the foreign importer and liaises with Japan Customs and the Forwarding Company/Customs Broker.

- Documentation and Compliance: ACP assists in preparing essential import documents (e.g., Invoices) in compliance with Japan Customs Law and formally requests the Customs Broker to proceed with customs clearance.

- Expert Consultation and Troubleshooting: We are a team of legal experts in Customs Laws, providing direct consultations with Japan Customs to ensure compliance and address issues, including troubleshooting unique challenges in non-resident imports.

How long does it take to complete ACP registration?

It will take approximately 2 weeks until receiving approval from Japan Customs. The breakdown of the task is as follows.

- Prepare the necessary documentation in coordination between the client and SK Advisory

- Start pre-consultation with Japan Customs and proceed with the initial review

- Submit a paper-based set of application documents to Japan Customs for final review

What documents are required for ACP application?

For example, but not limited to: a Power of Attorney, company registry documents, the calculation method for customs valuation, product catalogs for the imported goods, and the business/logistics flow.

ACP can handle all kinds of goods?

While many ACP service providers do not handle the regulated items, our ability to handle those regulated items has become a competitive advantage of our company. We can support the items including cosmetics, PSE-regulated products, foodstuffs, and tableware.

Which regions in Japan are we covering?

We can handle shipments to any region in Japan.

What is the difference between ACP and IOR?

ACP is not the Importer. ACP enables non-resident entities to become IOR (Importer of Record).

Contact

Contact us 24 hours through the form

Recommended Content