ACP stands for Attorney for Customs Procedures. In principle, foreign entities cannot become the Importer of Record (IOR). However, if the entity appoints an ACP, the foreign entity can become the IOR. Let’s look at the steps for importing goods by appointing an ACP.

The first step is a “regulatory check”.

“ACP registration” is the second step.

And lastly “start shipment of the goods to Japan”.

As a first step, we need to check the eligibility to handle the goods, especially by looking at import regulations of the goods. ACP is not capable of handling all kinds of goods. We always check the eligibility as a first step.

The second step is to proceed with ACP registration. The foreign entity and the ACP together need to submit ACP application documents to a respective Japan Customs Office. ACP can lead the preparation of the application documents on behalf of the foreign entity, but some information must be provided by the foreign entity such as a Company Registry, a Power of Attorney, etc.

During the application process, ACP has a series of discussions with Japan Customs. At this stage, we should also discuss with Customs Officers regarding how to set a proper customs value of the import goods. In total, it takes 2 weeks to complete the ACP registration on average.

Once we obtain the acceptance letter from the Japan Customs Office, you are then entitled to act as the IOR. You can start shipping your goods to Japan by using one of the logistics providers. In the meantime, ACP leads the preparation of the documents required for the import clearance, such as invoices and evidence materials of the customs value to be used. When the products arrive in Japan, ACP will coordinate these documents with the designated logistics provider, so that the logistics provider can proceed with import clearance in Japan. Once the import clearance has been done, the logistics provider can deliver the goods to the destination where the foreign entity would like to send them, such as an Amazon fulfillment center (FC) in Japan.

Contact

Contact us 24 hours through the form

Recommended Content

Please Be Aware

- In cases where foreign corporations (non-residents) without an office in Japan import or export goods, failure to properly prepare an Importer of Record (IOR) or Exporter of Record (EOR) through an Attorney for Customs Procedures (ACP) or similar means can result in goods being held at customs, leading to significant delays and costs. To avoid such risks, please make thorough preparations.

- If an ACP is needed, it is crucial to utilize the services of an experienced ACP well-versed in customs-related laws and regulations. The import and export operations of non-residents/foreign corporations using an ACP are treated as unique cases. Many customs brokers are not familiar with these procedures, leading to incidents where goods are detained for extended periods due to unsuccessful explanations to customs. (Customs will not permit the import if the explanations provided by the importer or customs broker are unsatisfactory, resulting in the goods being detained until customs is convinced.)

- We highly recommend utilizing our services as professional experts in customs, knowledgeable about customs-related laws and regulations. With a proven track record of resolving numerous issues through direct consultations with customs officers and customs brokers, our clients supported as an ACP now exceed 200 companies. We are committed to delivering industry-leading results with our expertise.

Contact

Contact us 24 hours through the form

Why choose us?

We specialize in navigating complex issues at the intersection of customs procedures and taxation—an area where our ability to offer practical, comprehensive support from both perspectives sets us apart. Understanding the close relationship between customs duties and national taxes (especially, Japan Consumption Tax - JCT), and addressing both in an integrated manner, is crucial in the context of international trade.

- Customs and International Trade Professionals - Led by our CEO, Mr. Sawada—Certified Customs Specialist and former KPMG professional—SK Advisory provides expert-level support in Customs and international trade. Mr. Sawada also serves as an external expert for the World Bank’s B-READY project in the field of customs and international trade.

- Full Compliance with Japanese Customs Law - We ensure full adherence to Japanese Customs Law, including Importer of Record (IOR) structure, HS code classification, and customs valuation. We assist in preparing all essential shipping documents for non-resident entities.

- One-Stop Support for ACP and JCT Tax Representative Services - In collaboration with trusted partner tax accountants, we provide comprehensive support for both customs procedures through the Attorney for Customs Procedures (ACP) and Japan Consumption Tax (JCT) filings through the JCT Tax Representative.

- Multilingual Communication - Our team communicates fluently in English, Japanese, and Chinese, offering smooth coordination with global clients and authorities in Japan.

- Support for Regulated Products - Our ACP/IOR partnership system can manage regulated items, including cosmetics, PSE-products, foodstuffs, and tableware.

- Trusted by Global Clients - Serving around 100 ACP clients annually, including many Amazon sellers, we’re a certified provider on Amazon SPN (Service Provider Network) under Trade Compliance.

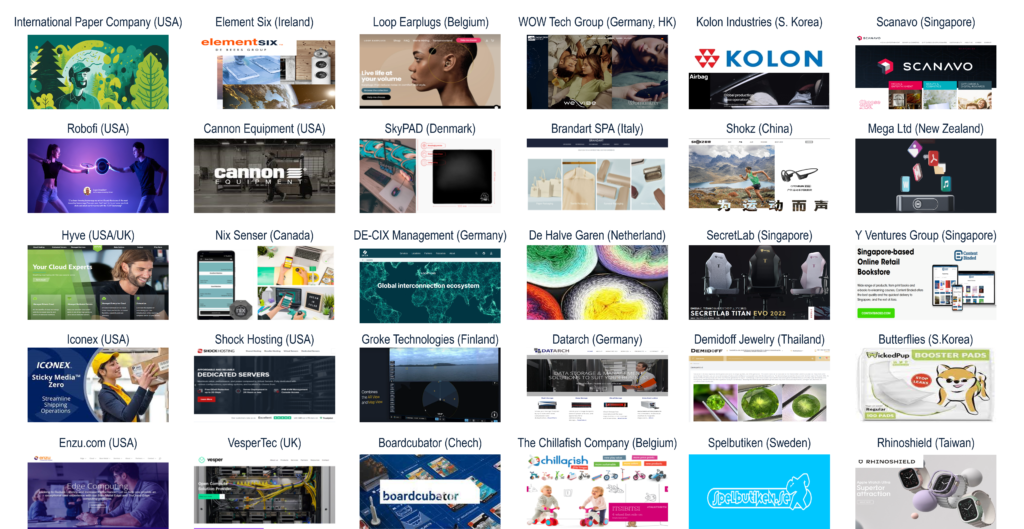

Track Record – Attorney for Customs Procedures (ACP) Services

We have supported import and export operations in Japan for over 200 clients across more than 40 countries.

Examples of International Logistics Partners We Have Worked With

We have a proven track record of working with a wide range of logistics providers. As the Attorney for Customs Procedures (ACP), we handle customs-related responsibilities while logistics companies manage transportation and warehousing operations.

- American Overseas Transport (AOT)

- Apex International

- Brink's

- CEVA Logistics

- Coshipper

- Crane Worldwide Logistics

- DB Schenker

- DGX (Dependable Global Express)

- DHL Express

- DHL Global Forwarding

- Dimerco

- DSV Air & Sea

- Expeditors

- FedEx Express

- FERCAM

- GOTO KAISOTEN Ltd.

- Harumigumi

- Herport

- ICL Logistics

- JAS Forwarding

- Kintetsu Express

- Kokusai Express

- Kuehne + Nagel

- Mitsubishi Logistics

- MOL Logistics

- Nankai Express

- Nippon Express

- OIA Global

- PGS

- Rhenus Group

- Röhlig

- Sankyu

- Sanyo Logistics

- Scan Global Logistics

- Seino Schenker

- SEKO Logistics

- Shibusawa Logistics Corporation

- Shin-Ei gumi

- Shiproad

- Sumitomo Warehouse

- UPS

- UPS Supply Chain Solutions

- Yamato Transport

...and many other logistics providers in Japan and around the world.

Contact

Contact us 24 hours through the form

Recommended Content

Our ACP Service: The Best Solution for the Japan Importer of Record (IOR) and Exporter of Record (EOR)

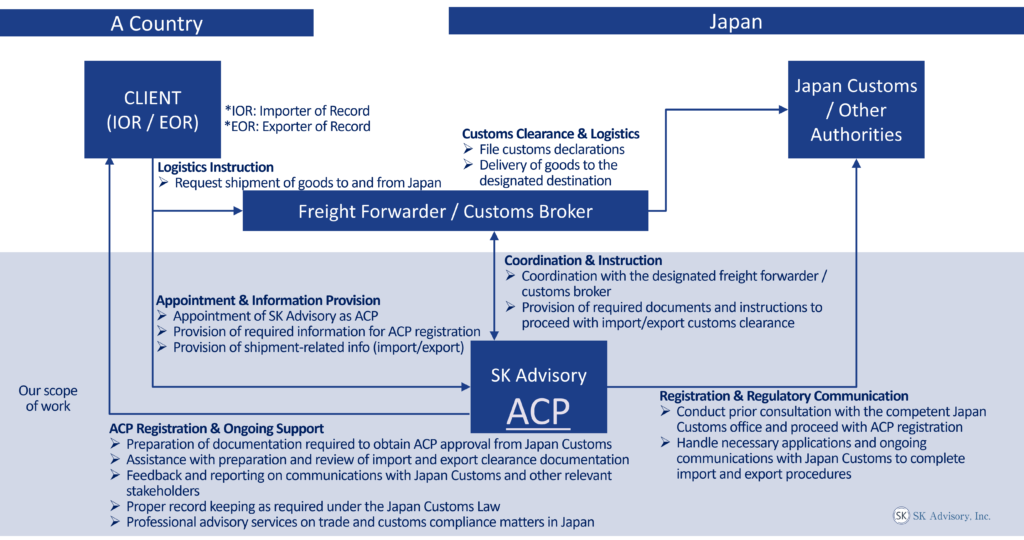

ACP is an effective solution for addressing Importer of Record (IOR) and Exporter of Record (EOR) requirements in Japan. Through our ACP service, non-resident entities located outside Japan are able to import and export goods as Non-Resident IOR and EOR.

Below is an overview of our basic scope of work, together with a diagram illustrating the operational structure of the ACP service. Once ACP registration is completed, the non-resident entity can act as the Importer of Record (IOR) and Exporter of Record (EOR) in Japan.

Scope of Work – How We Can Assist

- Consultation with Japan Customs to support successful ACP registration.

- Liaison with relevant stakeholders, including freight forwarders and Japan Customs, to ensure the smooth and compliant import and export of goods.

- Assistance in preparing and reviewing import and export clearance documentation.

- Support in the calculation of customs value, in accordance with the Japan Customs Tariff Act.

- Assistance with advance rulings on HS classification, customs valuation, and rules of origin.

- Import compliance support for regulated products, including Domestic Administrator (sometimes referred to as “Domestic Representative”) Services under the Product Safety Acts (PSE/PSC) and food-related products regulated under the Food Sanitation Act.

- Support for security export control, including list-based classification, catch-all control assessment, and assistance with export license applications to the Ministry of Economy, Trade and Industry (METI).

- Record-keeping support in accordance with Article 95 of the Japan Customs Law.

- Provision of professional trade and customs advisory services to address and resolve issues that may arise during import or export operations.

**Both import and export activities can benefit from the use of an ACP (Attorney for Customs Procedures). This support is applicable in scenarios where a non-resident acts as the Importer of Record (IOR) for imports and as the Exporter of Record (EOR) for exports.

Three Steps to Initiate Shipments Under the ACP Program:

Quotation Review to Contract Conclusion: Upon receiving your contact details, we will promptly provide a quotation for your review.

Commencing the Registration of ACP (Attorney for Customs Procedures) to Japan Customs: This process is generally completed in about two weeks.

Initiation of First Shipment, Import/Export

Recommended Content

Contact

Contact us 24 hours through the form