Conditions for Becoming an Importer of Record (IOR) in Japan

In Japan, the Customs Act defines the criteria for who can become an Importer of Record (IOR). Following the revision of the Customs Act Basic Notice in October 2023, the conditions for becoming an importer have been further tightened. As a result, it has become difficult for foreign corporations without an office in Japan to designate another third party Japanese entity as the nominal importer. Instead, there is an increasing number of cases where foreign corporations must become importers themselves by utilizing an Attorney for Customs Procedures (ACP).

Definition of an Importer

According to Customs Act Basic Notice 6-1, an importer is defined as follows:

Customs Act Basic Notice 6-1

The interpretation of terms related to taxpayers as stipulated in Article 6 of the Act is as follows:

(1) "Person who imports goods" refers, in principle, to the Consignee listed on the invoice (or the bill of lading if there is no invoice) for goods imported through a "import transaction" (as defined in Article 4, Paragraph 1 of the Customs Tariff Act).

This indicates that when there is an "import transaction," the consignee is typically recognized as the importer. The term "import transaction" is defined in the Customs Tariff Act as follows:

A transaction conducted between a seller and a buyer who has a base (address, residence, head office, branch office, office, place of business, or equivalent) in Japan, with the purpose of bringing goods into Japan, resulting in the actual arrival of the goods in Japan.

Typically, when a sales transaction meets this definition, the consignee becomes the importer. However, the receiver of the goods does not necessarily have to be the consignee as the importer.

For example, in cases where we act as an Attorney for Customs Procedures (ACP), if goods are sent to a Japanese buyer through a transaction between a foreign seller and a Japanese buyer, but the Japanese buyer does not become the importer due to contractual reasons, the foreign seller can become the importer (using ACP). The foreign seller then imports the goods and subsequently sells them within Japan.

However, it is not straightforward for a foreign seller to obtain approval from Japan Customs to act as the importer in B2B transactions. The ACP must use specialized knowledge and legal reasoning to explain the situation to customs authorities and obtain approval.

Cases That Do Not Qualify as "Import Transactions"

Upon reviewing the definition of "import transaction," it becomes clear that it is limited to transactions where the buyer has a base in Japan. Therefore, transactions where a foreign corporation without a base in Japan purchases goods overseas and sends them to Japan, or imports through transactions without a sale, do not qualify as "Import Transactions." In such cases, the conditions for becoming an importer are defined as follows:

Customs Act Basic Notice 67-3-3-2

The definition of "person intending to import goods" as stipulated in Article 59, Paragraph 1, Item 1 of the Ordinance is as follows:

- For goods imported through an import transaction, the definition is the same as "person who imports goods" as stipulated in 6-1(1) above.

- In cases other than those in (1) above, the person who has the authority to dispose of the imported goods after domestic clearance at the time of the import declaration, including any other person involved in the import for the intended purpose. Examples of such persons include:

- A person who leases and uses goods imported under a lease agreement.

- A person who sells goods imported for consignment sales under their own name.

- A person who processes or repairs goods imported for that purpose.

- A person who destroys goods imported for that purpose.

It is important to note that the "person intending to import goods" is liable for paying the applicable customs duties under Article 6 of the Act.

Thus, even in cases that do not qualify as "Import Transactions," a person who has the authority to dispose of the imported goods can be recognized as the importer. Many of the foreign corporations we support as ACP are recognized as importers because they have the authority to dispose of the goods.

Contact

Contact us 24 hours through the form

Recommended Content

Our ACP Service: The Best Solution for the Japan Importer of Record (IOR) and Exporter of Record (EOR)

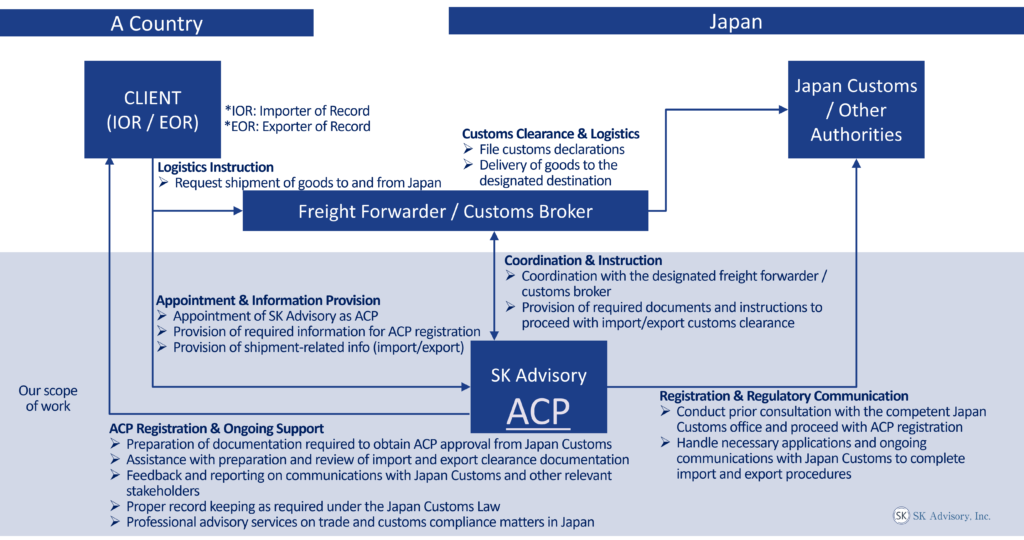

ACP is an effective solution for addressing Importer of Record (IOR) and Exporter of Record (EOR) requirements in Japan. Through our ACP service, non-resident entities located outside Japan are able to import and export goods as Non-Resident IOR and EOR.

Below is an overview of our basic scope of work, together with a diagram illustrating the operational structure of the ACP service. Once ACP registration is completed, the non-resident entity can act as the Importer of Record (IOR) and Exporter of Record (EOR) in Japan.

Scope of Work – How We Can Assist

- Consultation with Japan Customs to support successful ACP registration.

- Liaison with relevant stakeholders, including freight forwarders and Japan Customs, to ensure the smooth and compliant import and export of goods.

- Assistance in preparing and reviewing import and export clearance documentation.

- Support in the calculation of customs value, in accordance with the Japan Customs Tariff Act.

- Assistance with advance rulings on HS classification, customs valuation, and rules of origin.

- Import compliance support for regulated products, including Domestic Administrator (sometimes referred to as “Domestic Representative”) Services under the Product Safety Acts (PSE/PSC) and food-related products regulated under the Food Sanitation Act.

- Support for security export control, including list-based classification, catch-all control assessment, and assistance with export license applications to the Ministry of Economy, Trade and Industry (METI).

- Record-keeping support in accordance with Article 95 of the Japan Customs Law.

- Provision of professional trade and customs advisory services to address and resolve issues that may arise during import or export operations.

**Both import and export activities can benefit from the use of an ACP (Attorney for Customs Procedures). This support is applicable in scenarios where a non-resident acts as the Importer of Record (IOR) for imports and as the Exporter of Record (EOR) for exports.

Three Steps to Initiate Shipments Under the ACP Program:

- Quotation Review to Contract Conclusion: Upon receiving your contact details, we will promptly provide a quotation for your review.

- Commencing the Registration of ACP (Attorney for Customs Procedures) to Japan Customs: This process is generally completed in about two weeks.

- Initiation of First Shipment, Import/Export

Contact

Contact us 24 hours through the form

Track Record – Attorney for Customs Procedures (ACP) Services

We have supported import and export operations in Japan for over 200 clients across more than 40 countries.

Examples of International Logistics Partners We Have Worked With

We have a proven track record of working with a wide range of logistics providers. As the Attorney for Customs Procedures (ACP), we handle customs-related responsibilities while logistics companies manage transportation and warehousing operations.

- American Overseas Transport (AOT)

- Apex International

- Brink's

- CEVA Logistics

- Coshipper

- Crane Worldwide Logistics

- DB Schenker

- DGX (Dependable Global Express)

- DHL Express

- DHL Global Forwarding

- Dimerco

- DSV Air & Sea

- Expeditors

- FedEx Express

- FERCAM

- GOTO KAISOTEN Ltd.

- Harumigumi

- Herport

- ICL Logistics

- JAS Forwarding

- Kintetsu Express

- Kokusai Express

- Kuehne + Nagel

- Mitsubishi Logistics

- MOL Logistics

- Nankai Express

- Nippon Express

- OIA Global

- PGS

- Rhenus Group

- Röhlig

- Sankyu

- Sanyo Logistics

- Scan Global Logistics

- Seino Schenker

- SEKO Logistics

- Shibusawa Logistics Corporation

- Shin-Ei gumi

- Shiproad

- Sumitomo Warehouse

- UPS

- UPS Supply Chain Solutions

- Yamato Transport

...and many other logistics providers in Japan and around the world.