The benefits of FTAs/EPAs are straightforward: they provide opportunities to reduce or eliminate customs duties through lower or zero tariff rates.

So what steps are required to use an FTA? First, it is necessary to identify the HS code of the exported goods. Based on this HS code, the next step is to compare the WTO tariff rate with the FTA preferential tariff rate. If the FTA provides a clear advantage, the third step is to check the applicable Product-Specific Rule (PSR) to determine whether the goods qualify as originating goods.

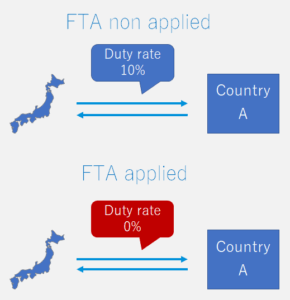

For example, when conducting trade between Japan and Country A, if no FTA is applied, the imported goods may be subject to the standard duty rate, such as 10%.

However, once the imported goods are eligible under an FTA, it becomes possible to enjoy lower or duty-free tariff rates.

It should be noted that, in order to benefit from an FTA, the importer must prepare appropriate documentation, such as a Certificate of Origin or a Declaration of Origin.

To issue these documents, the origin determination process must be conducted in accordance with the relevant Rules of Origin stipulated in each FTA.

As this determination process can be complex, we support our clients by guiding them through the process so that importers can properly benefit from FTA preferential tariff rates.

Contact

Contact us 24 hours through the form

YouTube - What is FTA (Free Trade Agreement)? How to use FTA in Japan to minimize tariff costs

Contact

Contact us 24 hours through the form