In this article, we provide a brief overview of FTAs (Free Trade Agreements). Especially how to use FTA when you trade with a company located in Japan.

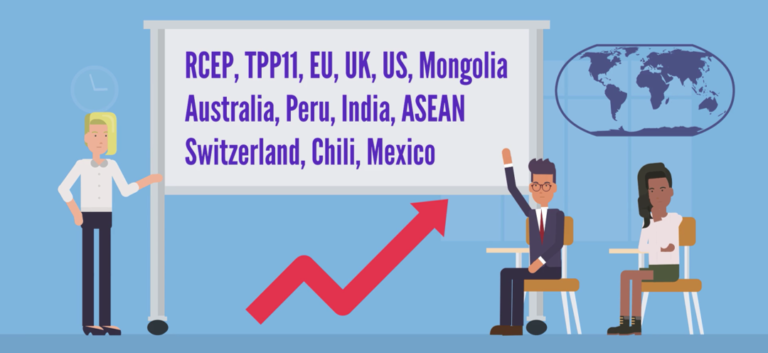

FTA is an abbreviation for Free Trade Agreement. FTAs are bilateral or multilateral agreements that aim to accelerate trade and investment through the elimination of tariffs. In Japan, the term EPA (Economic Partnership Agreement) is often used as a synonym, but from the perspective of eliminating tariffs, FTA and EPA are largely the same in terms of tariff elimination. As of January 2026, Japan has concluded 21 FTAs. Since 2000, the Japanese government has been very active in increasing the number of partner countries. Recently, there has been a rise in the number of mega FTAs with huge economic regions such as RCEP, TPP11, and EU-Japan.

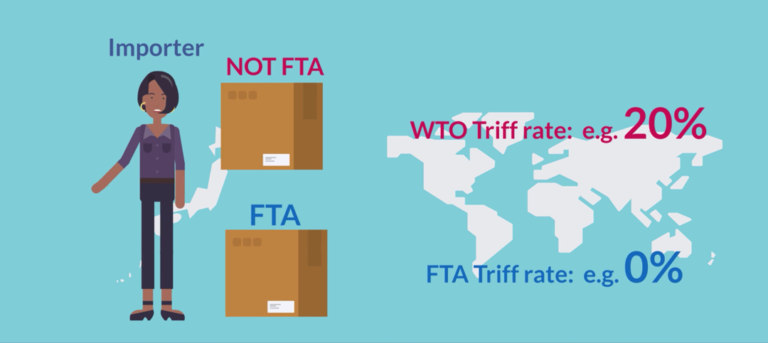

The main benefit of an FTA is straightforward: tariff reduction. If you do not use an FTA, you will have to pay tariffs based on the WTO tariff rate in most cases. While this does not apply to all products, in most cases, using an FTA allows imports at a lower tariff rate.

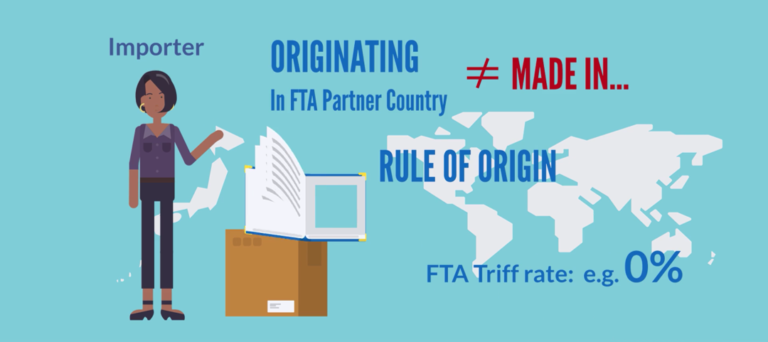

In order to use an FTA, the imported goods must be "Originating Goods". People often misunderstand that a product marked “Made in [country name]” automatically qualifies as an originating good. Actually, “Made in”, does not mean the goods are originating products. Whether the goods are originating or not is determined by the “Rule of origin” which is stipulated in each FTA agreement. Also, please bear in mind that the “Rule of origin” varies depending on the HS code. This specific rule set for each HS code is called a “Product-Specific Rule (PSR).”

So what steps are required to use FTA? The first action is to check the HS code of the exported goods. Using this HS code, the next action is to check the WTO tariff rate and FTA preferential rate when using FTA. If you can confirm that there is an advantage when you use FTA, then the third step is to check the “Product-Specific Rule (PSR)” to see whether the product can be originating goods or not.

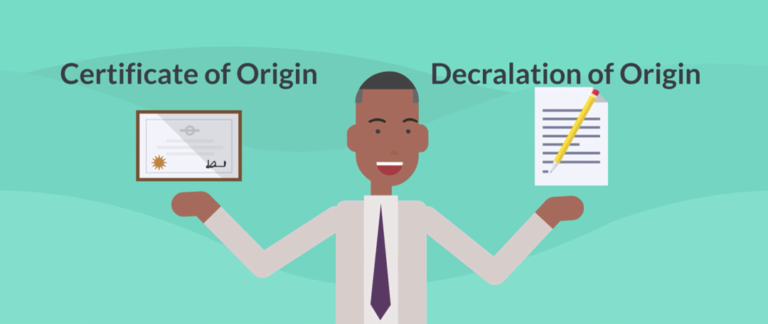

If you can confirm that the product can be considered an originating product, the final step is to prepare a Certificate of Origin. In each country, there is a certain authority to issue the Certificate of Origin. For instance, in Japan, the Certificate of Origin is issued by the Japan Chamber of Commerce (JCCI). Some FTAs allow the exporter or importer to prepare the origin declaration document by their own.

Once ready for the documentation, the exporter sends the Certificate of Origin to the importer and the logistics provider who will manage import clearance. The importer then requests the customs broker to proceed with import clearance using the applicable FTA.

For more information, please feel free to contact us as we can support all the necessary preparation to use FTA for your trading business.

YouTube - What is FTA (Free Trade Agreement)? How to use FTA in Japan to minimize tariff costs

Contact

Contact us 24 hours through the form

Recommended Content