Hand-Carry Imports to Japan by Foreign Businesses (Non-Residents)

If a foreign business without a physical presence in Japan (non-resident) wishes to bring goods into Japan by hand-carrying them, there are two main customs clearance procedures available.

1. Simplified (Traveler’s) Customs Clearance

If the goods are in small quantities and of low value—generally up to three units per item and a total taxable value under approximately JPY 300,000—they may be cleared as personal belongings under the simplified customs clearance procedure for travelers. In such cases, the process is relatively simple and can often be completed directly with customs, without involving a licensed customs broker.

2. Normal (Commercial) Customs Clearance

If the goods exceed the simplified clearance limits in either quantity or value (over JPY 300,000), a normal customs clearance is required. This typically involves coordination with a licensed customs broker.

Under Japanese customs law, non-resident foreign entities cannot act as the Importer of Record (IOR). However, by appointing SK Advisory Inc. as your Attorney for Customs Procedures (ACP), even non-resident companies can conduct import procedures in their own name.

How We Support

We can introduce a trusted customs broker experienced in hand-carry import clearance procedures. In addition, we will act as your ACP (so that you can legally act as Importer of Record (IOR) in Japan) and assist throughout the process to ensure smooth and compliant importation into Japan.

If your company is considering hand-carry imports into Japan, feel free to contact us for professional support.

🔗 Reference Links

Contact

Contact us 24 hours through the form

Recommended Content

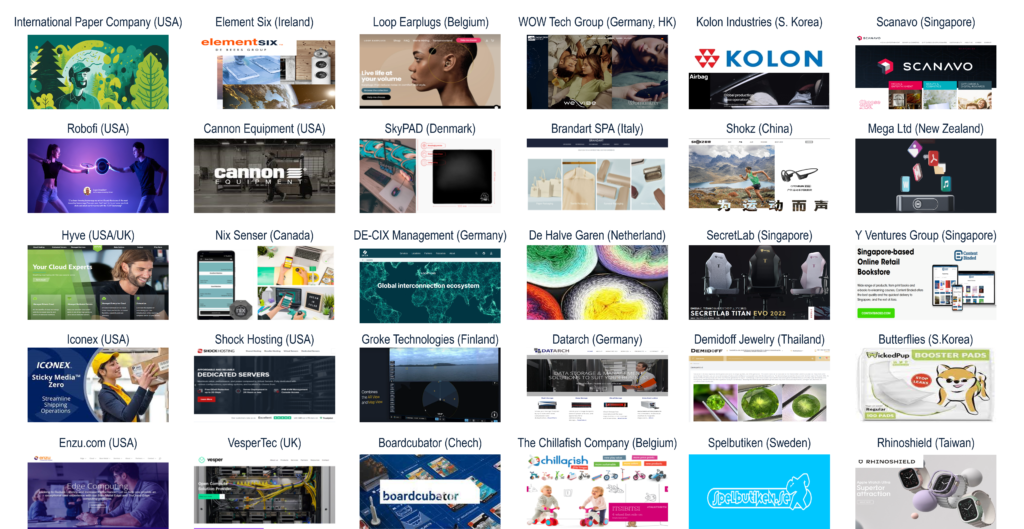

Track Record – Attorney for Customs Procedures (ACP) Services

We have supported import and export operations in Japan for over 200 clients across more than 40 countries.