Japan as a Strategic Market Amid Global Tariff Risks: Export to Japan Using ACP and EPA

Rebuilding Supply Chains in an Era of Increasing Tariff Uncertainty

Since the inauguration of the Trump administration in the United States, global trade has faced increasing uncertainty due to rising protectionist policies and retaliatory tariffs. Tariffs represent a direct cost to businesses, and exporting to countries such as the U.S. or China—where additional tariffs have been imposed—is becoming increasingly complex and financially burdensome.

In response, many global companies are reevaluating their supply chains and carefully analyzing the trade policies of each country to mitigate these growing risks.

Why Japan — Now More Than Ever

What we at SK Advisory Inc. would like to emphasize is that Japan offers a remarkably stable, transparent, and opportunity-rich market. The country maintains one of the lowest average tariff rates in the world and has signed numerous Economic Partnership Agreements (EPAs). These EPAs allow products from a wide range of origin countries to benefit from zero or reduced tariffs—a strategic advantage that can be fully utilized with customs expert guidance from SK Advisory.

While many countries are moving toward greater protectionism, Japan continues to welcome international trade and investment, both politically and economically. With a large consumer base, a sizable population, and strong domestic demand, Japan presents a highly attractive market that stands out for its stability, openness, and business-friendliness, particularly in today’s unpredictable global environment.

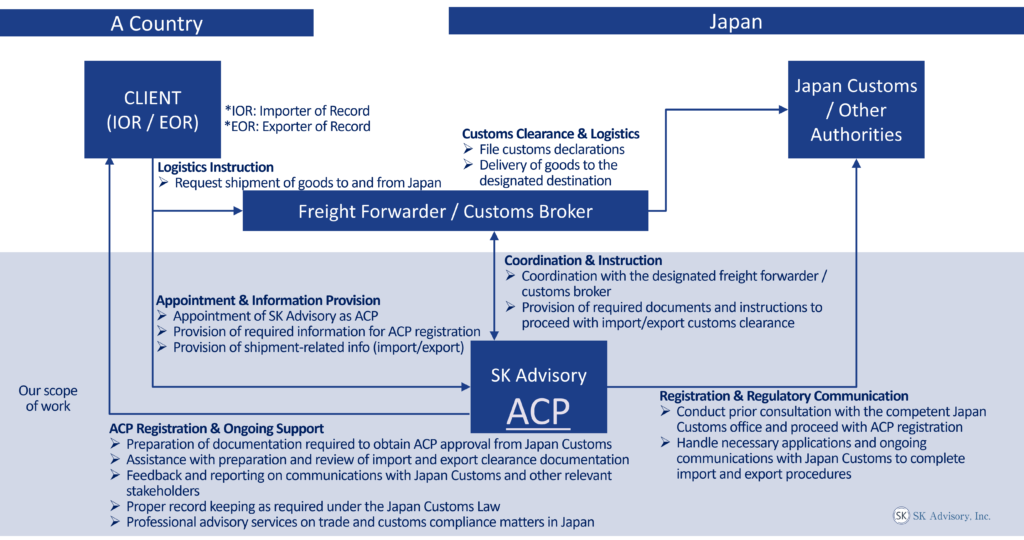

Even if your company does not have a physical presence in Japan, you can still import and sell directly into the Japanese market by appointing SK Advisory Inc. as your Attorney for Customs Procedures (ACP). In doing so, you can act as your own Importer of Record (IOR) or Exporter of Record (EOR) and maintain full control over your Japan-side operations.

In fact, many of our clients are already operating successfully in Japan by using cross-border e-commerce platforms such as Amazon Japan, Rakuten, Shopify, or third-party logistics (3PL) warehouses. They store inventory locally and manage order fulfillment through customized systems—all without establishing a Japanese office or subsidiary. Japan provides the infrastructure, regulatory transparency, and logistics ecosystem needed to make this business model both feasible and effective.

At SK Advisory Inc., we support global businesses in taking their first step into the Japanese market by leveraging our extensive experience and proven track record. We also work closely with trusted logistics partners and tax professionals, offering comprehensive support across customs, tax compliance, logistics and supply chain setup support.

If you are considering exporting to Japan or entering the Japanese market, please feel free to contact us. We’re here to help you navigate every step of the process with confidence.

Contact

Contact us 24 hours through the form

Recommended Content

Track Record – Attorney for Customs Procedures (ACP) Services

We have supported import and export operations in Japan for over 200 clients across more than 40 countries.

What is Japan ACP - Attorney for Customs Procedures

In principle, Japan Customs does not permit a foreign entity to act as the Importer of Record (IOR).

However, a foreign entity can overcome this restriction and act as a non-resident IOR by appointing an Attorney for Customs Procedures (ACP) who can handle the customs procedures on your behalf.

ACP is the optimal solution for resolving the IOR issue in Japan.

At SK Advisory, we have extensive experience in supporting numerous non-resident customers by acting as their ACP.

By leveraging our services, all of our customers have successfully become non-resident IORs in Japan.

What is Japan IOR - Importer of Record

When sending goods to Japan, for import, there must be a Japan Importer of Record (IOR) in place.

The importer, in principle, shall be a Japanese resident entity which is responsible for taxes, customs duties, as well as import-related regulations.

Unlike other regions, Japan Customs does not permit a foreign entity to act as Japan IOR.

However, by appointing ACP (Attorney for Customs Procedures), a foreign entity can become a Non-Resident Importer (IOR) thereby enabling the foreign entity to import goods directly.

Our ACP Service: The Best Solution for the Japan Importer of Record (IOR) and Exporter of Record (EOR)

ACP is an effective solution for addressing Importer of Record (IOR) and Exporter of Record (EOR) requirements in Japan. Through our ACP service, non-resident entities located outside Japan are able to import and export goods as Non-Resident IOR and EOR.

Below is an overview of our basic scope of work, together with a diagram illustrating the operational structure of the ACP service. Once ACP registration is completed, the non-resident entity can act as the Importer of Record (IOR) and Exporter of Record (EOR) in Japan.

Scope of Work – How We Can Assist

- Consultation with Japan Customs to support successful ACP registration.

- Liaison with relevant stakeholders, including freight forwarders and Japan Customs, to ensure the smooth and compliant import and export of goods.

- Assistance in preparing and reviewing import and export clearance documentation.

- Support in the calculation of customs value, in accordance with the Japan Customs Tariff Act.

- Assistance with advance rulings on HS classification, customs valuation, and rules of origin.

- Import compliance support for regulated products, including Domestic Administrator (sometimes referred to as “Domestic Representative”) Services under the Product Safety Acts (PSE/PSC) and food-related products regulated under the Food Sanitation Act.

- Support for security export control, including list-based classification, catch-all control assessment, and assistance with export license applications to the Ministry of Economy, Trade and Industry (METI).

- Record-keeping support in accordance with Article 95 of the Japan Customs Law.

- Provision of professional trade and customs advisory services to address and resolve issues that may arise during import or export operations.

**Both import and export activities can benefit from the use of an ACP (Attorney for Customs Procedures). This support is applicable in scenarios where a non-resident acts as the Importer of Record (IOR) for imports and as the Exporter of Record (EOR) for exports.

Three Steps to Initiate Shipments Under the ACP Program:

- Quotation Review to Contract Conclusion: Upon receiving your contact details, we will promptly provide a quotation for your review.

- Commencing the Registration of ACP (Attorney for Customs Procedures) to Japan Customs: This process is generally completed in about two weeks.

- Initiation of First Shipment, Import/Export

Contact

Contact us 24 hours through the form

Recommended Content