Japan JCT Tax Obligations for Foreign Corporations with a Capital of JPY 10 Million or More (Amendments to the Consumption Tax Law, April 2024)

Consumption tax in Japan applies to the transfer of assets conducted domestically by businesses, which means that non-residents and foreign corporations are also subject to consumption tax and are obliged to pay it if they transfer assets within Japan.

In some cases, such as exempt businesses, it may not be necessary to pay the tax to the national tax office.

However, the following are examples where one cannot qualify as an exempt business and must file for consumption tax:

Examples where JCT tax filing is required:

- Qualified JCT Invoice Issuers

- Businesses with taxable sales exceeding JPY 10 million in the base period (roughly speaking, the fiscal year two years prior) for the taxable period

- Businesses with taxable sales exceeding JPY 10 million for the specified period (roughly speaking, the first six months of the previous fiscal year, etc.)

- New corporations (including specified newly established corporations) with capital or investment of JPY 10 million or more for taxable periods without a base period

- Businesses that have made the election to become a taxable enterprise

※ With the amendments to the Consumption Tax Law in April 2024, regarding point 4, if a foreign corporation has capital or contributions exceeding 10 million yen when they start business operations in Japan (including specified newly established corporations), regardless of when the corporation was established abroad, they are obliged to pay taxes and declare from the fiscal year they start operations in Japan (applicable for taxable periods starting after October 1, 2024).

We specialize in navigating complex issues at the intersection of customs procedures and taxation—an area where our ability to offer practical, comprehensive support from both perspectives sets us apart. Understanding the close relationship between customs duties and national taxes (especially, Japan Consumption Tax - JCT), and addressing both in an integrated manner, is crucial in the context of international trade.

Contact

Contact us 24 hours through the form

Recommended Content

What Is a JCT Tax Representative and Why Is It Required?

When a non-resident foreign entity becomes subject to Japan’s Consumption Tax (JCT), it is required to appoint a JCT Tax Representative (Tax Agent).

If a non-resident company sells goods to customers in Japan, it typically collects 10% consumption tax on those sales. This collected JCT must be reported and submitted to the Japanese National Tax Office, unless the entity qualifies as a tax-exempt business. (See: "Are we a Tax-Exempt Business?")

If the entity is JCT-liable—or voluntarily registers as a taxable entity, such as by obtaining a Qualified Invoice Issuer Number—it must appoint a JCT Tax Representative to handle all tax-related procedures in Japan, including JCT tax filings.

In the JCT tax return process, the paid import JCT can be offset against the collected JCT.

- If the import JCT exceeds the collected amount, the difference may be refunded.

- If the collected JCT exceeds the import amount, the difference must be paid to the tax office.

A JCT Tax Representative is legally required to manage this process on behalf of the foreign entity.

Please note:

The JCT Tax Representative is distinct from the Attorney for Customs Procedures (ACP), which is appointed for customs clearance purposes.

- ACP = Customs representative

- JCT Tax Representative = Tax representative

Our Japan Consumption Tax (JCT) Representative Services

At SK Advisory Inc., we provide a comprehensive one-stop service that covers both customs procedures through the Attorney for Customs Procedures (ACP) and Japan Consumption Tax (JCT) procedures with the National Tax Agency through a designated JCT Tax Representative.

By working closely with our trusted partner tax accountants, we act as your ACP while maintaining close coordination and information sharing with the tax representative. This collaboration ensures the proper deduction and refund of Japan Consumption Tax paid at the time of importation.

Contact

Contact us 24 hours through the form

Recommended Content

JCT Compliance

Understanding the handling of JCT (such as payment of import JCT, collection of sales JCT from customers, and JCT returns) is crucial to avoid significant cost burdens. This is a vital aspect, so please ensure a thorough understanding to determine the most optimal business model.

Basic procedure

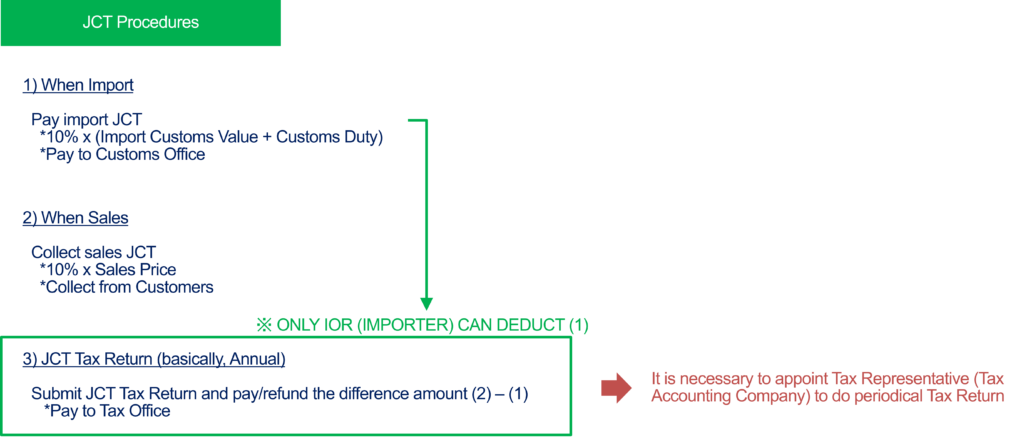

For non-resident entities (Company-A) that import and sell goods to customers in Japan, the standard procedure involves three steps:

- Pay import Japan Consumption Tax (JCT) to a customs office, 10% of the import customs value when Company-A imports goods. <PAY TO CUSTOMS OFFICE>

- Obtain JCT from customers in Japan, 10% of the sales price when Company-A sells goods.

- Submit JCT tax return and pay the difference amount (2) – (1) to a tax office periodically <PAY TO TAX OFFICE (different authority from Customs Office)>

Note: Using ACP to become the importer (IOR) is essential for JCT deductions and refunds. If another company acts as the IOR, you cannot deduct the input tax (step 1), and must pay the entire VAT collected (step 2) to the national tax authorities, leading to significant costs.

If you are a JCT-exempt business, the process ends at steps 1 and 2. For taxable businesses or invoice-registered businesses, step 3 (Final Tax Return) is obligatory.

In the Final Tax Return (step 3), if the JCT paid (step 1) exceeds the provisional JCT received (step 2), the difference is refunded. Conversely, if the provisional JCT received (step 2) exceeds the JCT paid (step 1), the difference must be paid to the tax office.

Why IMPORTER is important?

It is crucial to note that only the IMPORTER can deduct the import consumption tax at the time of tax filing. (= Deduct above (1) from (2) )

If Company-A uses another company to act IMPORTER, then Company-A can’t do above (3). Company-A has to pay all the amount of (2) to a tax office.

However, if Company-A imports goods using the Attorney for Customs Procedure (ACP), it becomes the Importer and can deduct the import consumption tax when filing the JCT tax return. In this case, Company-A only needs to pay the difference between the JCT collected from customers and the import JCT (2) – (1) paid to the Tax Office.

Contact

Contact us 24 hours through the form

Recommended Content

Appoint a tax accounting firm as Tax Representative / Tax Agent

Apart from utilizing ACP, when filing taxes in Japan (3), Company-A must appoint a Tax Representative. The Tax Representative will handle JCT tax registration and JCT filings with the tax office on behalf of the non-resident entity. SK Advisory can introduce our partner tax accounting company that can act as the Tax Representative.

Contact

Contact us 24 hours through the form

Recommended Content

Are we a Tax-Exempt Business?

Tax Filing Obligations of Nonresidents and Foreign Corporations

First, the consumption tax received from customers in Step 2 above should basically be paid to the national tax office. Consumption tax is imposed on transfers, etc. of assets made in Japan. Therefore, even if a nonresident or foreign corporation transfers assets in Japan, it is subject to consumption tax and is obligated to pay the tax.

In some cases, such as exempt businesses, it may not be necessary to pay the tax to the national tax office.

However, the following are examples where one cannot qualify as an exempt business and must file for consumption tax:

Examples of Entities Required to File JCT Tax Returns (Non-Exempt Businesses)

- Qualified Invoice Issuers:

Businesses registered as qualified invoice issuers under Japan’s invoice system. - Businesses with Taxable Sales Exceeding JPY 10 Million During the Base Period:

Entities whose taxable sales in Japan during the base period (generally the fiscal year two years prior) exceed JPY 10 million. - Businesses with Taxable Sales Exceeding JPY 10 Million During the Specific Period:

Entities whose taxable sales in Japan during the specific period (generally the first six months of the previous fiscal year) exceed JPY 10 million. - Newly Established Corporations with Capital of JPY 10 Million or More:

Newly established corporations (including certain newly established corporations) with capital or investment of JPY 10 million or more during a taxable period without a base period. - Foreign Corporations with Capital of JPY 10 Million or More Deemed to Have No Base Period: (Applicable to taxable periods starting on or after October 1, 2024) *

Foreign corporations without a base period and with capital or investment of JPY 10 million or more at the start of the fiscal year are not exempt from consumption tax obligations. - Businesses Opting for Taxable Enterprise Status:

Entities that voluntarily select to be treated as taxable enterprises.

*Important Notes on the 2024 JCT Tax Law Amendment

Under the 2024 amendment of Japan’s Consumption Tax Law, the exemption for foreign corporations initiating business in Japan has been significantly tightened.

Foreign corporations with no base period and capital of JPY 10 million or more at the beginning of the fiscal year are no longer exempt from consumption tax obligations during that fiscal year.

Starting from taxable periods beginning on or after October 1, 2024, a foreign corporation that has an existing base period but was primarily conducting business outside Japan and subsequently starts taxable business activities in Japan after the day following the end of its base period will be deemed as having no base period.

Being "deemed to have no base period" means that if the corporation’s capital or investment is JPY 10 million or more, it will incur consumption tax obligations from the deemed base period fiscal year onward.

As a result of this amendment, many foreign corporations will be required to file consumption tax in Japan from their first year of business operations in the country.

Disclaimer: The above outlines the general principles of Japan’s consumption tax obligations. Each company’s specific tax liability should be confirmed by consulting with a licensed tax accountant.

If you’re an Exempted entity

During the exempt term, a new entity is not required to file tax returns. As long as your entity has exempt status, you are only required to:

(1) Pay 10% tax of the import customs value when you import goods.

(2) Collect 10% of the sales price when you sell goods.

That’s all. You can enjoy the difference (2) – (1).

Can Tax-Exempt Businesses Receive Refunds?

Yes, however, a final JCT tax return (Step 3) is required in order to receive a refund. Even if your business is initially classified as tax-exempt, you may voluntarily register as a taxable entity and begin filing JCT tax returns to claim refunds for import JCT you have paid.

This can be beneficial, for example, when the JCT paid at import (Step 1) exceeds the JCT collected from customers (Step 2). In such cases, the difference may be refunded by the National Tax Office.

Importantly, to claim a refund or deduction for import JCT, the use of an Attorney for Customs Procedures (ACP) is essential for non-resident businesses—only ACP-registered importers are eligible for JCT recovery.

Recommended Content

Contact

Contact us 24 hours through the form

Japan Qualified Invoice System and Compliance JCT (Japan Consumption Tax)

Recently, many companies have been registering as Qualified Invoice Issuers for Japanese Consumption Tax (JCT) due to the new invoice system introduced in October 2023. This new system is similar to the EU's VAT invoice system.

After October 2023, your Japanese customer can’t claim input JCT tax credits unless the sellers(suppliers) issue a qualified invoice that is written a JCT number. To issue a qualified invoice, sellers(suppliers) need to be a taxable entity and get a JCT number.

Before October 2023:

Any customer (Company-B) who paid for goods or services could deduct input JCT regardless of whether the seller (Company-A) was registered for JCT. There was no requirement to verify the tax status of the seller.

After October 2023:

Any customer (Company-B) can only deduct input JCT if Company-A, the seller, is registered and can provide a qualified invoice with a JCT registration number. If Company-A cannot issue such an invoice, Company-B may choose not to continue purchases from them.

If Company-A sells only to consumers and not businesses, it may not need to issue qualified invoices since consumers typically do not claim JCT tax returns.

Once Company-A obtains a JCT invoice registration number, it becomes a taxable entity required to file JCT returns regularly.

For non-resident entities (Company-A) importing and selling in Japan, the standard procedure involves three steps:

- Pay import JCT to customs: 10% of the import customs value.

- Collect JCT from customers in Japan: 10% of the sales price.

- File a JCT tax return and pay the net JCT to the tax office.

If Company-A paid the import JCT as the importer using an Attorney for Customs Procedures (ACP), they need only pay the net amount of sales JCT minus import JCT.

If Company-A paid the import JCT but was not the importer, they must pay all the collected sales JCT without deducting the import JCT.

Therefore, using an ACP to act as the Importer of Record (IOR) is crucial for managing JCT deductions and refunds. If another company acts as the IOR, you cannot deduct the import JCT, resulting in significant costs.

We strongly recommend using our ACP services to ensure you can act as IOR, optimizing your JCT handling. Our team has extensive experience helping clients become importers and successfully manage their JCT responsibilities. You can rely on our expertise to navigate these complexities.

Is It Better to Become a Registered Invoice Issuer?

This depends on individual circumstances, but generally speaking, for B2B where customers are corporations, it's better to be a Registered Invoice Issuer (as corporations file JCT returns and need qualified invoices for input tax deductions). For B2C where customers are primarily consumers, the necessity is somewhat reduced (as most consumers do not file JCT returns).

Many companies seem to become Registered Invoice Issuer without fully understanding the system. Being a registered business mandates the filing of a final tax return (step 3). Please seek advice from appropriate experts.

Is Support from a Certified Tax Accountant Necessary?

For non-residents conducting tax office procedures (step 3) in Japan, appointing a Tax Representative is required. The ACP handles customs procedures, while the Tax Representative deals with national tax (tax office) matters. Under the Certified Tax Accountant Act, the following tasks are exclusively performed by the Certified Tax Accountants, making their support essential:

- Preparation of tax documents

- Tax representation

- Tax consultation

Our company, in partnership with Certified Tax Accountants skilled in international taxation, will provide support in these areas.

Track Record – Attorney for Customs Procedures (ACP) Services

We have supported import and export operations in Japan for over 200 clients across more than 40 countries.

Examples of International Logistics Partners We Have Worked With

We have a proven track record of working with a wide range of logistics providers. As the Attorney for Customs Procedures (ACP), we handle customs-related responsibilities while logistics companies manage transportation and warehousing operations.

- American Overseas Transport (AOT)

- Apex International

- Brink's

- CEVA Logistics

- Coshipper

- Crane Worldwide Logistics

- DB Schenker

- DGX (Dependable Global Express)

- DHL Express

- DHL Global Forwarding

- Dimerco

- DSV Air & Sea

- Expeditors

- FedEx Express

- FERCAM

- GOTO KAISOTEN Ltd.

- Harumigumi

- Herport

- ICL Logistics

- JAS Forwarding

- Kintetsu Express

- Kokusai Express

- Kuehne + Nagel

- Mitsubishi Logistics

- MOL Logistics

- Nankai Express

- Nippon Express

- OIA Global

- PGS

- Rhenus Group

- Röhlig

- Sankyu

- Sanyo Logistics

- Scan Global Logistics

- Seino Schenker

- SEKO Logistics

- Shibusawa Logistics Corporation

- Shin-Ei gumi

- Shiproad

- Sumitomo Warehouse

- UPS

- UPS Supply Chain Solutions

- Yamato Transport

...and many other logistics providers in Japan and around the world.