Japan National Tax Agency - Entities Merely Handling Customs Procedures Cannot Be Importers of Record and Cannot Deduct Consumption Tax on Imports

The National Tax Agency website provides insights reflecting the customs system revision in October 2023.

As previously mentioned (link - Mandatory to Use ACP, Introduction of Two New Systems in Japan), the revision has tightened the requirements for entities that can become importers. It no longer allows third-party entities merely acting as customs brokers or nominal importers on behalf of another company to be the importer of record. This also means that such entities cannot claim the Japan Import Consumption Tax (Import JCT), as only the importer can claim this deduction.

The National Tax Agency website advises that foreign entities should use an Attorney for Customs Procedures (ACP) to act as the importer of record and claim the consumption tax refund or deduction for imports. Therefore, both the National Tax Agency and Japan Customs recommend using an Attorney for Customs Procedures (ACP) for non-resident entities to act as Importer of Record (IOR). Our company specializes in providing ACP services and has supported numerous foreign corporations.

Please feel free to contact us for assistance.

Handling of Consumption Tax Deduction When Entrusted with Customs Arrangements by Foreign Entities (National Tax Agency Website)

Inquiry to National Tax Agency:

We, a customs broker, have been entrusted by "Company A", a foreign entity, to handle customs arrangements for products they plan to sell to customers in Japan. We will also manage the transportation of these products to a domestic warehouse. After transporting the goods to the domestic warehouse, "Company A" remains the seller and not our company. However, our company will temporarily bear the import consumption tax for withdrawing the products from the bonded area and will later receive reimbursement from "Company A". In this case, which entity is entitled to deduct the import consumption tax: our company (the customs broker) or “Company A,” the taxpayer?

Response from National Tax Agency:

"Company A", a foreign entity, should claim the import consumption tax deduction in their consumption tax return (JCT tax return). Reasoning: The consumption tax deduction applies to taxable purchases made domestically and to taxable cargo withdrawn from bonded areas. According to Article 30 of the Consumption Tax Act, the entity eligible for the consumption tax deduction is the one who withdraws the taxable cargo, i.e., the entity that made the import declaration. If there is no buy/sell transaction for the import, the import declaration must be made by the entity with the authority to dispose of the imported goods after withdrawal from the bonded area. Since your company is only handling customs arrangements and transportation to a domestic warehouse, it does not have the authority to dispose of the goods post-withdrawal and thus does not qualify as the importer of record. Therefore, if "Company A" is a taxable business entity, the import consumption tax deduction should be claimed by "Company A", the entity with the authority to dispose of the goods, and not by your company as the customs broker. Note: For "Company A" (foreign entity) to make the import declaration, it must appoint an Attorney for Customs Procedures (ACP).

We specialize in navigating complex issues at the intersection of customs procedures and taxation—an area where our ability to offer practical, comprehensive support from both perspectives sets us apart. Understanding the close relationship between customs duties and national taxes (especially, Japan Consumption Tax - JCT), and addressing both in an integrated manner, is crucial in the context of international trade.

Contact

Contact us 24 hours through the form

Recommended Content

Our Japan Consumption Tax (JCT) Representative Services

At SK Advisory Inc., we provide a comprehensive one-stop service that covers both customs procedures through the Attorney for Customs Procedures (ACP) and Japan Consumption Tax (JCT) procedures with the National Tax Agency through a designated JCT Tax Representative.

By working closely with our trusted partner tax accountants, we act as your ACP while maintaining close coordination and information sharing with the tax representative. This collaboration ensures the proper deduction and refund of Japan Consumption Tax paid at the time of importation.

Contact

Contact us 24 hours through the form

Recommended Content

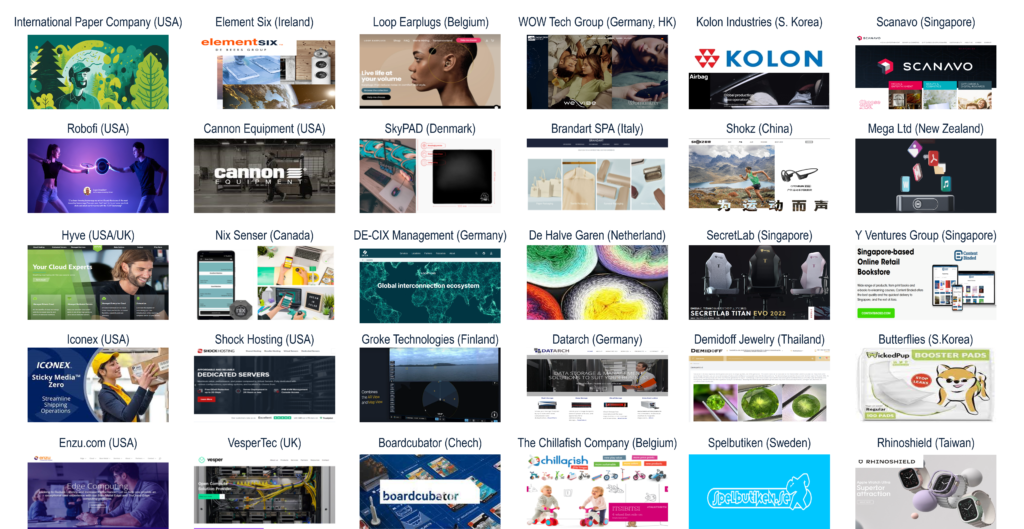

Track Record – Attorney for Customs Procedures (ACP) Services

We have supported import and export operations in Japan for over 200 clients across more than 40 countries.

Examples of International Logistics Partners We Have Worked With

We have a proven track record of working with a wide range of logistics providers. As the Attorney for Customs Procedures (ACP), we handle customs-related responsibilities while logistics companies manage transportation and warehousing operations.

- Apex International

- Brink's

- CEVA Logistics

- Crane Worldwide Logistics

- DB Shenker

- DGX(Dependable Global Express)

- DHL Express

- DHL Global Forwarding

- Dimerco

- DSV Air & Sea

- Expeditors

- FedEx Express

- FERCAM

- Harumigumi

- Herport

- ICL Logistics

- JAS Forwarding

- Kintetsu Express

- Kokusai Express

- Kuehne + Nagel

- Mitsubishi Logistics

- MOL Logistics

- Nankai Express

- Nippon Express

- OIA Global

- PGS

- Rhenus Group

- Röhlig

- Sankyu

- Sanyo Logistics

- Scan Global Logistics

- Seino Schenker

- SEKO Logistics

- Shin-Ei gumi

- Sumitomo Warehouse

- UPS

- UPS Supply Chain Solutions

- Yamato Transport

...and many other logistics providers in Japan and around the world.