What Foreign Companies Should Know About Japan Import/Export and ACP & JCT Solutions

Introduction - How to Import and Export in Japan Without a Local Entity

At SK Advisory, we have supported numerous foreign companies—especially those without a physical presence in Japan—in navigating the complexities of importing into and exporting from Japan. Based on our experience, this article outlines the main challenges foreign entities face and how our services as Attorney for Customs Procedures (ACP) and JCT (Japan Consumption Tax) Representative offer practical solutions. These solutions enable foreign companies (non-residents) without a local entity to successfully import into and export from Japan.

1. Absence of Local Importer or Exporter in Japan

Under Japanese Customs Law, foreign entities without a registered address in Japan are not allowed to act as the Importer of Record (IOR) or Exporter of Record (EOR). However, by appointing a local representative called an Attorney for Customs Procedures (ACP) or Customs Procedures Agent (CPA), a foreign business can legally act as the importer and exporter in Japan.

While in traditional trade models the Japanese buyer usually serves as the importer, we are increasingly seeing various new business structures such as:

Cross-border e-commerce sellers (e.g., Amazon FBA, Rakuten) importing and storing products at warehouses in Japan

Temporary imports for exhibitions, shows or events

Importing equipment or servers for internal use (e.g., for data centers)

In these scenarios, no local importer exists at the time of customs clearance. This often results in the goods being held at Japan Customs due to the absence of an IOR. While we are experienced in handling urgent cases like this, it is strongly recommended to appoint an ACP in advance—before shipping—to avoid costly delays and complications.

Recap:

No local importer in Japan?

→ Appoint an Attorney for Customs Procedures (ACP) so that your company can legally act as the Importer of Record (IOR) in Japan.

No local exporter in Japan?

→ Likewise, appoint an ACP so that your company can act as the Exporter of Record (EOR), even without a physical presence in Japan.

2. Stricter Requirements for Becoming an Importer in Japan

Following revisions to the Customs Law Guidelines in October 2023, Japanese authorities have significantly tightened the rules regarding who can act as an importer. Importing under the name of an unrelated Japanese company is no longer allowed.

In many cases, our foreign clients retain ownership of the goods at the time of import. In such instances, it is essential that the foreign entity itself be the importer—with the appointment of an ACP as their representative in Japan.

The ACP also plays a critical role in tax matters. To be eligible for a refund or deduction of the 10% Japan Import Consumption Tax (JCT), the importer must be officially listed as the Importer of Record (IOR) on the Import Permit document.

Contact

Contact us 24 hours through the form

Recommended Content

3. Import Taxes: Customs Duties and JCT

There are two main types of import taxes in Japan:

▶ Customs Duty:

Tariff rates vary depending on the HS code; however, most industrial products are either duty-free or subject to low rates in Japan. You can check tariff rates at Japan Customs Website: JP Tariff Rates

▶ Japan Consumption Tax (JCT):

JCT is set at a fixed rate of 10%. JCT is calculated as 10% of the total import declaration value plus customs duty. For more detailed information about JCT, please visit our webpage: Consumption Tax

Tax Filing and Payment to the Tax Office

After importing goods, you are allowed to collect 10% Japan Consumption Tax (JCT) from customers upon domestic sales. If you are a JCT-exempt entity, no further action is required.

If you are a JCT-taxable entity, you must file a JCT tax return with the local tax office and pay the collected sales JCT. During this process, you may deduct or claim a refund of the JCT paid at the time of import.

Only the Importer of Record Can Claim Input Tax Credit

The right to claim an input tax credit for import JCT belongs exclusively to the Importer of Record (IOR). This is why appointing an Attorney for Customs Procedures (ACP) is critical. If the foreign company does not act as the importer—such as when a third party is listed as the IOR—the company may lose the right to reclaim the import JCT, resulting in a significant financial loss.

Compliance with the Japanese Invoice System

Since October 2023, Japan has implemented a new JCT Invoice System, similar to the European VAT compliance framework. Foreign sellers must consider whether to register as a Qualified Invoice Issuer, particularly when selling to JCT-registered buyers in Japan. If a foreign seller is not registered as a Qualified Invoice Issuer, the buyer may be unable to fully claim input JCT through their JCT tax return.

To maintain good business relationships, it is often advisable to register proactively. However, once registered as a Qualified Invoice Issuer, you can no longer be treated as a tax-exempt entity and must begin filing and paying JCT accordingly.

Necessary to Appoint a Tax Representative

To complete this process—registration and JCT filing—a Tax Representative (usually a certified Japanese tax accountant) must be appointed separately from the ACP.

We work closely with trusted tax professionals to provide comprehensive, one-stop support for both ACP and JCT Tax Representative services.

4. Import Value (Customs Valuation)

Calculating the correct import declaration value (Customs Valuation) is one of the most complex areas. Typically, the transaction price (CIF adjusted) between an unrelated foreign seller and a Japanese buyer is used.

However, we are often asked by foreign clients whether they can apply a cost-based price between their overseas entities and suppliers. Unfortunately, the answer is no, as the transaction value method is only applicable when the seller is located outside Japan and the buyer is an entity in Japan.

When a valid transaction price is not available, customs authorities require an alternative valuation method. If it is apparent that the goods will be sold in Japan, the domestic selling price—adjusted for local logistics and distribution costs—is typically used as the basis for customs valuation.

That said, Japan’s low tariff rates mean this valuation mainly affects JCT rather than Customs Duty. And as noted, if you're properly set up as IOR and appoint a JCT Tax Representative, JCT is recoverable and not a cost, so there is no need to overly stress about the declared value.

🔗 How to Determine Import Value for Amazon FBA

Contact

Contact us 24 hours through the form

Recommended Content

5. Export: Export Control & JCT Exemption

Foreign entities can also act as Exporter of Record (EOR) by appointing an ACP.

However, Japan’s export controls—especially for sensitive goods like semiconductors—have become stricter. Exporters must conduct product classification, determine whether a license is needed, and sometimes obtain permission from Japan’s Ministry of Economy, Trade and Industry (METI). We support our clients in these compliance areas as part of our ACP service.

Additionally, foreign sellers may be eligible for JCT export exemption, allowing them to claim a refund of input JCT paid on domestic purchases in Japan. However, only the Exporter of Record (EOR) can apply for this. Therefore, it is essential that you become the EOR by appointing an Attorney for Customs Procedures (ACP).

Conclusion

For foreign entities, successfully conducting import/export operations in Japan requires more than simply customs clearance. Legal compliance with customs and tax authorities is essential.

By appointing a professional Attorney for Customs Procedures (ACP) and a JCT Tax Representative, foreign businesses can remain compliant while expanding into the Japanese market.

If you have any questions, please don’t hesitate to contact us at SK Advisory.

Contact

Contact us 24 hours through the form

Recommended Content

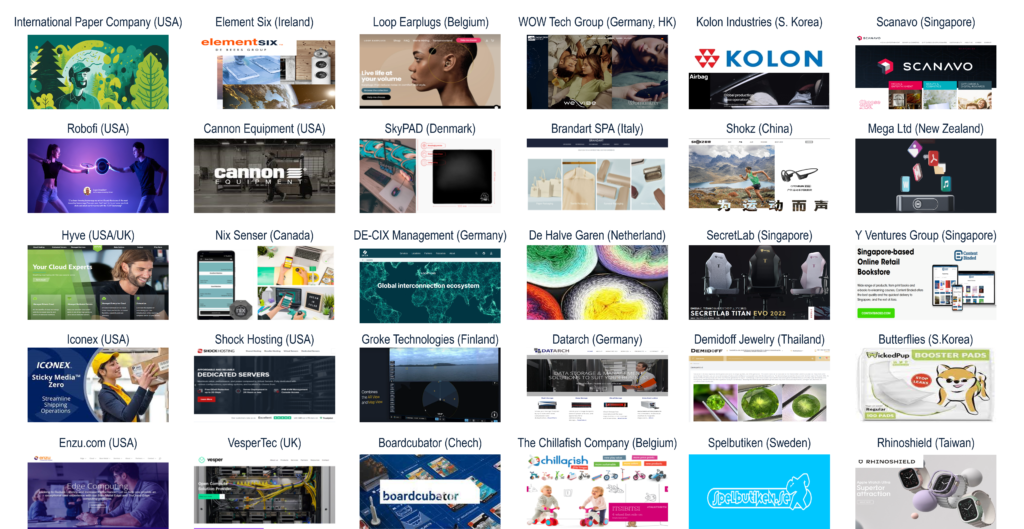

Track Record – Attorney for Customs Procedures (ACP) Services

We have supported import and export operations in Japan for over 200 clients across more than 40 countries.