Question 6: What is the Fall-back Method?

The Fall-back Method for customs valuation in Japan allows for a flexible determination of the import value when the conditions for the standard valuation methods are not met. SK Advisory conducts consultations with Japan Customs to determine the appropriate calculation method for the import value.

The Fall-back Method is stipulated under Article 1-12 of the Cabinet Order for Enforcement of the Customs Tariff Act of Japan, and the following two specific approaches are provided:

a) A price calculated by making reasonable adjustments to the methods prescribed in Articles 4 to 4-3 (Paragraph 1, Article 1-12 of the Cabinet Order for Enforcement of the Customs Tariff Act)

b) Where (a) is not applicable, a price calculated based on a method determined by the Director-General of Customs, in accordance with Article VII of the General Agreement on Tariffs and Trade 1994 and the Agreement on Implementation of Article VII of the General Agreement on Tariffs and Trade 1994 (WTO Valuation Agreement) (Paragraph 2, Article 1-12 of the Cabinet Order for Enforcement of the Customs Tariff Act)

What is a “reasonable adjustment” ?

Where the basic conditions for applying the primary method, the Identical or Similar Goods Value Method, the Deductive Value Method, or the Computed Value Method are not satisfied, the customs value shall be determined by making reasonable adjustments to those conditions.

The sequential order of Articles 4 to 4-3 shall still be respected in determining the customs value.

For example, if a domestic sale was made 120 days after the import declaration—rather than within the standard 90-day period—and no other appropriate domestic selling price is available, the domestic selling price at 120 days may be used to calculate the customs value.

Q&A for Customs Valuation

Recommended Content

Contact

Contact us 24 hours through the form

Reference: Customs Tariff Law, Japan Customs

Why choose us?

- Customs and International Trade Professionals - Our CEO, Mr. Sawada, is a Certified Customs Specialist in Japan. With years of experience providing services in the Trade & Customs field, his leadership at KPMG and the establishment of his own company, SK Advisory, ensures our commitment to excellence and high-quality service. Mr. Sawada also serves as an external expert for the World Bank’s B-READY project in the field of customs and international trade.

- Full Adherence to Japanese Customs Law - Our top priority is to maintain full compliance with Japanese Customs Law and safely import / export our clients' goods into / from Japan. We meticulously manage all import compliance aspects, including Japan Importer of Record (IOR) matter, HS code classification and the correct Customs Valuation of goods entering Japan. We support to complete all the necessary shipping documents, such as Invoice, Packing List and BL, on behald of non-resident / foreign Japan IOR.

- Communication in English, Chinese, and Japanese - Our team, with extensive international experience, excels in communication in English, including facilitating English-language meetings, and has earned considerable trust from clients. We also have staff capable of communicating in Chinese, making us equipped to handle Chinese-language support as well. Naturally, as a Japan-based team, we're totally fluent in Japanese, ensuring seamless communication across these three key languages.

- Reputable and Reliable Partner -The growing demand for our Attorney for Customs Procedures (ACP) services is testament to our quality. We proudly serve clients globally, registering over 100 ACP customers annually. Our consistent track record underscores our reliability and credibility.

- Handling Regulated Products - Our ACP/IOR partnership system can manage regulated items, including cosmetics, PSE-products, foodstuffs, and tableware.

- Recognized ACP Service Provider on Amazon SPN (Service Provider Network) - We are a certified ACP service provider within Amazon's Service Provider Network (SPN), listed under the Trade Compliance category. Many international Amazon Sellers have successfully become Japan Importers of Record (IOR) through our ACP services.

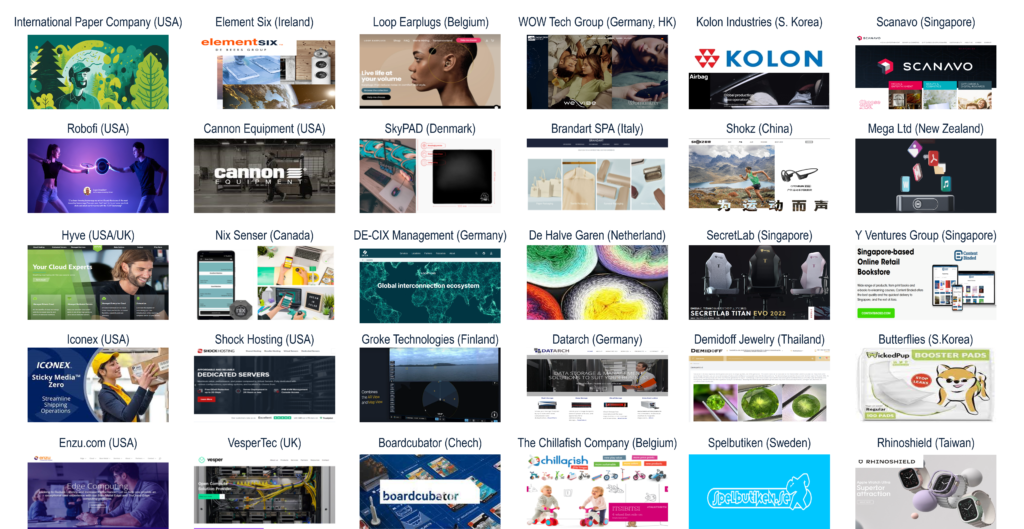

Track Record – Attorney for Customs Procedures (ACP) Services

We have supported import and export operations in Japan for over 200 clients across more than 40 countries.

Examples of International Logistics Partners We Have Worked With

We have a proven track record of working with a wide range of logistics providers. As the Attorney for Customs Procedures (ACP), we handle customs-related responsibilities while logistics companies manage transportation and warehousing operations.

- American Overseas Transport (AOT)

- Apex International

- Brink's

- CEVA Logistics

- Coshipper

- Crane Worldwide Logistics

- DB Schenker

- DGX (Dependable Global Express)

- DHL Express

- DHL Global Forwarding

- Dimerco

- DSV Air & Sea

- Expeditors

- FedEx Express

- FERCAM

- GOTO KAISOTEN Ltd.

- Harumigumi

- Herport

- ICL Logistics

- JAS Forwarding

- Kintetsu Express

- Kokusai Express

- Kuehne + Nagel

- Mitsubishi Logistics

- MOL Logistics

- Nankai Express

- Nippon Express

- OIA Global

- PGS

- Rhenus Group

- Röhlig

- Sankyu

- Sanyo Logistics

- Scan Global Logistics

- Seino Schenker

- SEKO Logistics

- Shibusawa Logistics Corporation

- Shin-Ei gumi

- Shiproad

- Sumitomo Warehouse

- UPS

- UPS Supply Chain Solutions

- Yamato Transport

...and many other logistics providers in Japan and around the world.

Contact

Contact us 24 hours through the form

Recommended Content

Japanese Customs System Reform: Clarification of Importer Definitions

Starting October 1, 2023, Japanese Customs has instituted a pivotal reform aimed at addressing the issue of foreign sellers improperly designating third parties (such as forwarders or customs agents) as importers.

This revision necessitates foreign corporations to utilize an Attorney for Customs Procedures (ACP) to assume the role of Importer of Record (IOR) directly in many cases. The practice of merely nominally appointing another entity as the importer is no longer feasible.

Notably, foreign corporations that act as importers themselves, through the engagement of ACP, are eligible for Japan Consumption Tax (JCT) benefits. (link: Consumption Tax Treatment and Benefits of Using ACP).

As a dedicated ACP firm, we ensure compliance with the law to facilitate correct import procedures, allowing you to trust us with your importation requirements confidently. We are eager to engage in further discussions with you.

Revisions Effective October 1, 2023:

Definition of the Importer

- Regarding a cargo imported under import transaction, an importer is equivalent to “a person who imports a cargo” defined in Article 6-1 (1), General Notification of the Customs Act. ….. This means, the Consignee, etc., in the case of imports conducted through normal transactions between an overseas seller and a Japanese buyer

- In the cases other than above, an importer is a Person Having the Right of Disposal of the import cargo at the time of import declaration. If there is another person who acts on the purpose of the import*, that person is also included:

In case of a cargo imported:

- under lease contracts, a person who rents and uses the cargo.

- for consignment sales, a person who sells the cargo in the name of himself/herself (consignee) by accepting the commission.

- for processing or repairing, a person who processes or repairs the cargo.

- for disposal, a person who disposes the cargo.

Importer Defined as the “Person Having the Right of Disposal”

One of the most notable aspects of the amendment is the clarification that the “person having the right of disposal” is regarded as the importer under Japan Customs law. The term “right of disposal” is similar to ownership, but not identical. Although there is no explicit definition in the customs-related legislation, according to Japan Customs, it refers to the authority to decide how the goods will be handled after being released into Japan—for example, whether to sell the goods or to enter into a sales contract.

For additional information, please refer to the following resources:

- Japan Customs: Leaflet(English) Revision of Import Declaration Items and Attorney for Customs Procedure (ACP) System

- English: Announcement from Japan Customs | Mandatory to Use ACP in Many Cases – Attorney for Customs Procedure

Our ACP Service: The Best Solution for the Japan Importer of Record (IOR) and Exporter of Record (EOR)

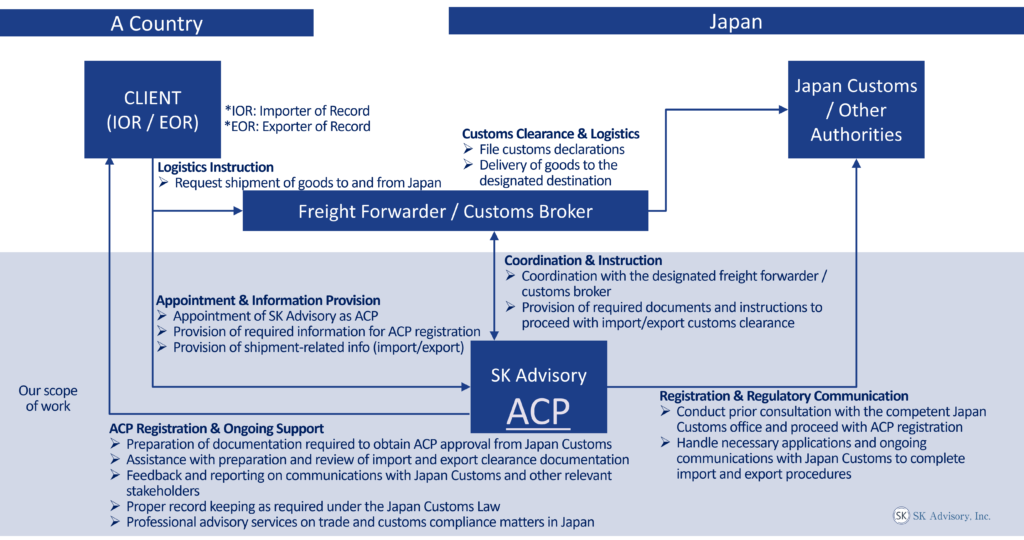

ACP is an effective solution for addressing Importer of Record (IOR) and Exporter of Record (EOR) requirements in Japan. Through our ACP service, non-resident entities located outside Japan are able to import and export goods as Non-Resident IOR and EOR.

Below is an overview of our basic scope of work, together with a diagram illustrating the operational structure of the ACP service. Once ACP registration is completed, the non-resident entity can act as the Importer of Record (IOR) and Exporter of Record (EOR) in Japan.

Scope of Work – How We Can Assist

- Consultation with Japan Customs to support successful ACP registration.

- Liaison with relevant stakeholders, including freight forwarders and Japan Customs, to ensure the smooth and compliant import and export of goods.

- Assistance in preparing and reviewing import and export clearance documentation.

- Support in the calculation of customs value, in accordance with the Japan Customs Tariff Act.

- Assistance with advance rulings on HS classification, customs valuation, and rules of origin.

- Import compliance support for regulated products, including Domestic Administrator (sometimes referred to as “Domestic Representative”) Services under the Product Safety Acts (PSE/PSC) and food-related products regulated under the Food Sanitation Act.

- Support for security export control, including list-based classification, catch-all control assessment, and assistance with export license applications to the Ministry of Economy, Trade and Industry (METI).

- Record-keeping support in accordance with Article 95 of the Japan Customs Law.

- Provision of professional trade and customs advisory services to address and resolve issues that may arise during import or export operations.

**Both import and export activities can benefit from the use of an ACP (Attorney for Customs Procedures). This support is applicable in scenarios where a non-resident acts as the Importer of Record (IOR) for imports and as the Exporter of Record (EOR) for exports.

Three Steps to Initiate Shipments Under the ACP Program: :

- Quotation Review to Contract Conclusion: Upon receiving your contact details, we will promptly provide a quotation for your review.

- Commencing the Registration of ACP (Attorney for Customs Procedure) to Japan Customs: This process is generally completed in about two weeks.

- Initiation of First Shipment, Import/Export

Recommended Content

Contact

Contact us 24 hours through the form