Japan JCT Tax Obligations for Foreign Corporations with a Capital of Over 10 Million Yen (Amendments to the Consumption Tax Law, April 2024)

Last Updated on May 1, 2024 by SK ADVISORY INC

Consumption tax in Japan applies to the transfer of assets conducted domestically by businesses, which means that non-residents and foreign corporations are also subject to consumption tax and are obliged to pay it if they transfer assets within Japan.

In some cases, such as exempt businesses, it may not be necessary to pay the tax to the national tax office.

However, the following are examples where one cannot qualify as an exempt business and must file for consumption tax:

Examples where JCT tax filing is required:

- Qualified JCT Invoice Issuer

- Businesses with taxable sales exceeding 10 million yen in the base period (roughly speaking, the fiscal year two years prior) for the taxable period

- Businesses with taxable sales exceeding 10 million yen for the specified period (roughly speaking, the first six months of the previous fiscal year, etc.)

- New corporations (including specified newly established corporations) with capital or investments of 10 million yen or more for taxable periods without a base period

- Businesses that have made the election to become a taxable enterprise

※ With the amendments to the Consumption Tax Law in April 2024, regarding point 4, if a foreign corporation has capital or contributions exceeding 10 million yen when they start business operations in Japan (including specifically newly established corporations), regardless of when the corporation was established abroad, they are obliged to pay taxes and declare from the fiscal year they start operations in Japan (applicable for taxable periods starting after October 1, 2024).

JCT Compliance

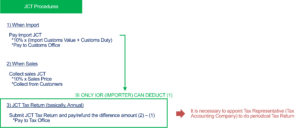

Understanding the handling of JCT (such as payment of import JCT, collection of sales JCT from customers, and JCT returns) is crucial to avoid significant cost burdens. This is a vital aspect, so please ensure a thorough understanding to determine the most optimal business model.

Basic procedure

For non-resident entities (Company-A) that import and sell goods to customers in Japan, the standard procedure involves three steps:

- Pay import Japan Consumption Tax (JCT) to a customs office, 10% of the import customs value when Company-A imports goods. <PAY TO CUSTOMS OFFICE>

- Obtain JCT from customers in Japan, 10% of the sales price when Company-A sells goods.

- Submit JCT tax return and pay the difference amount (2) – (1) to a tax office periodically <PAY TO TAX OFFICE (different authority from Customs Office)>

Note: Using ACP to become the importer (IOR) is essential for JCT deductions and refunds. If another company acts as the IOR, you cannot deduct the input tax (step 1), and must pay the entire VAT collected (step 2) to the national tax authorities, leading to significant costs.

If you are a JCT-exempt business, the process ends at steps 1 and 2. For taxable businesses or invoice-registered businesses, step 3 (Final Tax Return) is obligatory.

In the Final Tax Return (step 3), if the JCT paid (step 1) exceeds the provisional JCT received (step 2), the difference is refunded. Conversely, if the provisional JCT received (step 2) exceeds the JCT paid (step 1), the difference must be paid to the tax office.

Why IMPORTER is important?

It is crucial to note that only the IMPORTER can deduct the import consumption tax at the time of tax filing. (= Deduct above (1) from (2) )

If Company-A uses another company to act IMPORTER, then Company-A can’t do above (3). Company-A has to pay all the amount of (2) to a tax office.

However, if Company-A imports goods using the Attorney for Customs Procedure (ACP), it becomes the Importer and can deduct the import consumption tax when filing the JCT tax return. In this case, Company-A only needs to pay the difference between the JCT collected from customers and the import JCT (2) – (1) paid to the Tax Office.

Appoint a tax accounting firm as Tax Representative / Tax Agent

Apart from utilizing ACP, when filing taxes in Japan (3), Company-A must appoint a Tax Representative. The Tax Representative will handle JCT tax registration and JCT filings with the tax office on behalf of the non-resident entity. SK Advisory can introduce our partner tax accounting company that can act as the Tax Representative.

Determination of JCT obligation (Taxable / Exempt)

Tax Payment Obligations of Nonresidents and Foreign Corporations

First, the consumption tax received from customers in Step 2 above should basically be paid to the national tax office. Consumption tax is imposed on transfers, etc. of assets made in Japan. Therefore, even if a nonresident or foreign corporation transfers assets in Japan, it is subject to consumption tax and is obligated to pay the tax.

However, there are cases in which a nonresident or foreign corporation is a tax-exempt enterprise and does not have to pay consumption tax to the national tax office (tax office). Generally speaking, if none of the following applies to you, you may not be required to file a consumption tax return as a tax-exempt business.

<Typical examples of businesses that are not tax-exempt and are required to file a consumption tax return>

- Qualified JCT Invoice Issuer

- Businesses with taxable sales exceeding 10 million yen in the base period (roughly speaking, the fiscal year two years prior) for the taxable period

- Businesses with taxable sales exceeding 10 million yen for the specified period (roughly speaking, the first six months of the previous fiscal year, etc.)

- Newly established corporations (including specified newly established corporations) with capital or investments of 10 million yen or more for taxable periods without a base period

- Businesses that have made the election to become a taxable enterprise

If you’re an Exempted entity

During the exempt term, a new entity is not required to file tax returns. As long as your entity has exempt status, you are only required to:

(1) Pay 10% tax of the import customs value when you import goods.

(2) Collect 10% of the sales price when you sell goods.

That’s all. You can enjoy the difference amount 2) – 1).

Can Tax-Exempt Businesses Receive Refunds?

Yes, it's possible, but a final tax return (step 3) is necessary. Even if you're an exempt business, you are still able to opt to submit a "Taxable Business Selection Notification" to the tax office, intentionally becoming a taxable business to file a final tax return and receive a refund for the paid import JCT. This is applicable only if the JCT paid at import (step 1) exceeds the provisional JCT collected (step 2). Note that using an ACP (Attorney for Customs Procedures) to act as the importer is essential for input tax deduction and refunds.

Japan Qualified Invoice System and Compliance JCT (Japan Consumption Tax)

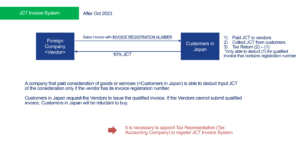

Recently, many companies have been registering as Qualified Invoice Issuers for Japanese Consumption Tax (JCT) due to the new invoice system introduced in October 2023. This new system is similar to the EU's VAT invoice system.

After October 2023, your Japanese customer can’t claim input JCT tax credits unless the sellers(suppliers) issue a qualified invoice that is written a JCT number. To issue a qualified invoice, sellers(suppliers) need to be a taxable entity and get a JCT number.

Before October 2023:

Any customer (Company-B) who paid for goods or services could deduct input JCT regardless of whether the seller (Company-A) was registered for JCT. There was no requirement to verify the tax status of the seller.

After October 2023:

Any customer (Company-B) can only deduct input JCT if Company-A, the seller, is registered and can provide a qualified invoice with a JCT registration number. If Company-A cannot issue such an invoice, Company-B may choose not to continue purchases from them.

If Company-A sells only to consumers and not businesses, it may not need to issue qualified invoices since consumers typically do not claim JCT tax returns.

Once Company-A obtains a JCT invoice registration number, it becomes a taxable entity required to file JCT returns regularly.

For non-resident entities (Company-A) importing and selling in Japan, the standard procedure involves three steps:

- Pay import JCT to customs: 10% of the import customs value.

- Collect JCT from customers in Japan: 10% of the sales price.

- File a JCT tax return and pay the net JCT to the tax office.

If Company-A paid the import JCT as the importer using an Attorney for Customs Procedures (ACP), they need only pay the net amount of sales JCT minus import JCT.

If Company-A paid the import JCT but was not the importer, they must pay all the collected sales JCT without deducting the import JCT.

Therefore, using an ACP to act as the Importer of Record (IOR) is crucial for managing JCT deductions and refunds. If another company acts as the IOR, you cannot deduct the import JCT, resulting in significant costs.

We strongly recommend using our ACP services to ensure you can act as IOR, optimizing your JCT handling. Our team has extensive experience helping clients become importers and successfully manage their JCT responsibilities. You can rely on our expertise to navigate these complexities.

Is It Better to Become a Registered Invoice Issuer?

This depends on individual circumstances, but generally speaking, for B2B where customers are corporations, it's better to be a Registered Invoice Issuer (as corporations file JCT returns and need qualified invoices for input tax deductions). For B2C where customers are primarily consumers, the necessity is somewhat reduced (as most consumers do not file JCT returns).

Many companies seem to become Registered Invoice Issuer without fully understanding the system. Being a registered business mandates the filing of a final tax return (step 3). Please seek advice from appropriate experts.

Is Support from a Certified Tax Accountant Necessary?

For non-residents conducting tax office procedures (step 3) in Japan, appointing a Tax Representative is required. The ACP handles customs procedures, while the Tax Representative deals with national tax (tax office) matters. Under the Certified Tax Accountant Act, the following tasks are exclusively performed by the Certified Tax Accountants, making their support essential:

- Preparation of tax documents

- Tax representation

- Tax consultation

Our company, in partnership with Certified Tax Accountants skilled in international taxation, will provide support in these areas.